Betty is age 34 and has AGI of $50,000 and regular taxable income of $35,000. The following

Question:

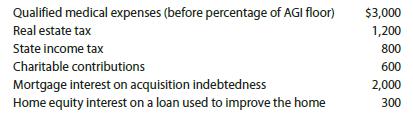

Betty is age 34 and has AGI of $50,000 and regular taxable income of $35,000. The following items may qualify as itemized deductions for Betty:

What is the alternative minimum taxable income (AMTI)?

a. $35,000

b. $37,500

c. $37,000

d. $52,800

Transcribed Image Text:

Qualified medical expenses (before percentage of AGI floor) $3,000 Real estate tax 1,200 State income tax 800 Charitable contributions 600 Mortgage interest on acquisition indebtedness Home equity interest on a loan used to improve the home 2,000 300

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

answer b 37500 steps Qualified medical expenses before percenta...View the full answer

Answered By

Churchil Mino

I have been a tutor for 2 years and have experience working with students of all ages and abilities. I am comfortable working with students one-on-one or in small groups, and am able to adapt my teaching style to meet the needs of each individual. I am patient and supportive, and my goal is to help my students succeed.

I have a strong background in math and science, and have tutored students in these subjects at all levels, from elementary school to college. I have also helped students prepare for standardized tests such as the SAT and ACT. In addition to academic tutoring, I have also worked as a swim coach and a camp counselor, and have experience working with children with special needs.

0.00

0 Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2022 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357519431

25th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young, David M. Maloney

Question Posted:

Students also viewed these Business questions

-

Betty is age 34 and has AGI of $50,000. The following items may qualify as itemized deductions for Betty: What are the itemized deductions allowed for the AMT? a. $2,500 b. $2,900 c. $3,400 d. $3,700...

-

Betty is age 34 and has AGI of $50,000. The following items may qualify as itemized deductions for Betty: What is the itemized deduction add-back for the AMT? a. $2,000 b. $2,800 c. $3,800 d. $8,800...

-

The following items may appear on a ban statement: 1. EFT payment 2. Note collected for company 3. Bank correction of an error from recording a $7,200 deposit as $2,700 4. Service charge using the...

-

(a) Find the Laplace transform of the voltage shown in Fig. 16.52(a). (b) Using that value of vs (t) in the circuit shown in Fig. 16.52(b), find the value of v0 (t). v,(0) 3 V 0 1s al 112

-

What ethical concerns arise in using reference group theory to sell products?

-

The income statement for Weatherford International Inc.s year ended December 31, 2014, was prepared by an inexperienced bookkeeper. As the new accountant, your immediate priority is to correct the...

-

A. In 2015, the Canadian province of British Columbia enacted regulations applicable to the sale of wine. Only wine produced in British Columbia could be sold on grocery store shelves. Wine produced...

-

The balance sheet caption for common stock is the following: Common stock without par value, 2,000,000 shares authorized, 400,000 shares issued, and 360,000 shares outstanding . . . . . . . . . . . ....

-

7. The full symbol of an ion of an element is 39X+? Which one of the following is the number of electrons in the ion? A. 18 B. 19 C. 20 D. 39 8. The atomic numbers of elements W, X, Y and Z are 9,...

-

How did Ralph Lauren violate the FCPA? Why did Ralph Lauren receive less severe penalties for the misconduct? How can the Ralph Lauren bribery case set a precedent for other firms when discovering...

-

Indigo, Inc., a closely held C corporation, incurs the following income and losses. a. Calculate Indigos taxable income. b. Would the answer in part (a) change if the passive loss was $320,000 rather...

-

In an e-mail to your instructor, outline an AMT planning opportunity not mentioned in the chapter. In the e-mail, discuss the feasibility of the suggested planning opportunity.

-

Find the quotient and the remainder. Check your work by verifying that (Quotient)(Divisor) + Remainder = Dividend -4x 3 + x 2 4 divided by x 2 + x + 1

-

Rate Duration Amount $75 Million $750 Million $175 Million 12 Percent 9 Percent 1.75 Years 7.00 Years Assets Cash Loans Treasuries Liabilities And Equity Time Deposits CDs Equity $350 Million S575...

-

1. You are provided with two IP addresses. 175.15.10.25/16 175.15.150.45/16 Answer the following questions. a) What is the netmask? b) what is the Network address? c) What is the broadcast address?...

-

At a local college, 55 female students were randomly selected and it was found that their mean monthly income was $638 with a population standard deviation of $125.50. Eighty-five male students were...

-

A chemist fills a reaction vessel with 4.91 atm chlorine (C12) gas, 9.54 atm phosphorus (P4) gas, and 8.10 atm phosphorus trichloride (PC13) gas at a temperature of 25.0C. Under these conditions,...

-

Share what we learn from the data and information collected for this discussion. Interpret each of the ratios. Review the Financial Ratios Guidelines document for direction. Do you see any red flags?...

-

Complete the coverage probability calculation needed in Example 9.2.17. a. If X22Y is a chi squared random variable with Y ~ Poisson(A), show that E(x22y) = 2λ, Var(x22Y) =...

-

Read Case Study Google: Dont Be Evil Unless and answer the following: Given its mission of providing information to the world, should Google censor searches in China?

-

Ashley runs a small business in Boulder, Colorado, that makes snow skis. She expects the business to grow substantially over the next three years. Because she is concerned about product liability and...

-

Franklin County is in dire financial straits and is considering a number of sources for additional revenue. Evaluate the following possibilities in terms of anticipated tax payer compliance. a. A...

-

Discuss the probable justification for each of the following aspects of the tax law. a. A tax credit is allowed for amounts spent to furnish care for minor children while the parent works. b....

-

Problem 1: Recall the simulation in PS5. An axisymmetric rigid body S (spacecraft) moves in an inertial reference frame N. Let , and , be unit vectors fixed in N and S, respectively. Assume that the...

-

Problem 1: Recall the simulation in PS5. An axisymmetric rigid body S (spacecraft) moves in an inertial reference frame N. Let , and , be unit vectors fixed in N and S, respectively. Assume that the...

-

2. The figure below illustrates a mass that is connected to a movable base via a spring and a damper. The positions of the mass and base are defined by x and xb, respectively. Assume that the mass...

Study smarter with the SolutionInn App