During 2021, Jos, a self-employed technology consultant, made gifts in the following amounts. In addition, on professional

Question:

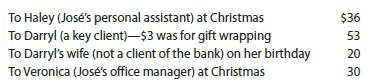

During 2021, José, a self-employed technology consultant, made gifts in the following amounts.

In addition, on professional assistants’ day, José takes Haley to lunch at a local restaurant at a cost of $82. Presuming that José has adequate substantiation, how much can he deduct?

Transcribed Image Text:

To Haley (José's personal assistant) at Christmas To Darryl (a key client)-$3 was for gift wrapping To Darryl's wife (not a client of the bank) on her birthday To Veronica (José's office manager) at Christmas $36 53 20 30

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (6 reviews)

The total amount that Jos can deduct is 191 This includes the 36 gift to ...View the full answer

Answered By

Hassan Raza

I have been tutoring for 2 years and have experience with a wide range of subjects and students. I am patient and adaptable, and I always make sure that my students understand the material before moving on. I also have a lot of experience with online tutoring, and I am comfortable using a variety of tools and platforms to help my students learn.

0.00

0 Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2022 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357519431

25th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young, David M. Maloney

Question Posted:

Students also viewed these Business questions

-

Stacy Ennis eats lunch at a local restaurant two or three times a week. In selecting a restaurant on a typical workday, Stacy uses three criteria. First is to minimize the amount of travel time,...

-

Encumbrances were recorded in the following amounts for purchase order issued against the appropriations indicated: Required: Record the encumbrances in the General Fund general jounal and Detail...

-

A self employed entrepreneur should include a salary that he could earn doing something else as an implicit cost towards his business. This opportunity cost would not be used to consider accounting...

-

Water flows in a partially full 2-m-diameter circular pipe an average velocity of 2 m/s. If the water depth in the pipe is 0.5 m, determine the flow area, the wetted perimeter, the hydraulic radius,...

-

Join an online social networking site of your choosing (e.g., MySpace, Facebook, LinkedIn). Observe and/or participate for a week. Write a report that examines the various strategies that marketers...

-

Required Refer to the information in Problem 17-11B. Prepare a statement of cash flows for 2014 using the direct method to report cash inflows and outflows from operating activities. Other...

-

For ryegrass that was not infected with endophyte the following data were observed: Infestation Rate Number of Ryegrass Plants (n) log (n+1) X Y 0 16 2.83321 0 23 3.17805 0 2 1.09861 0 16 2.83321 0 6...

-

TRM Consulting Services currently has the following capital structure: New debt would mature on June 30, 2040, have a coupon rate of 8%, and would be sold for their par value of $1,000. The bonds pay...

-

push ('Arabic') push ('French') pop() push ('English') push ('Spanish') 1) Draw this stack (In an array of 5 elements implementation) 2) What is the language given by the Top element? 3) In which...

-

Refer to the Journal of Agricultural, Biological, and Environmental Statistics (Sept. 2000) study of the mortality of rice weevils exposed to low oxygen, presented in Exercise 8.92 (p. 408). Recall...

-

How do U.S. individuals generate their income? Does it vary by size of income (AGI)? Go to the IRS tax statistics website (irs.gov/statistics), and look for recent information on sources of income...

-

Many see the step-up in basis at death rule as an expensive tax loophole enjoyed by the wealthy. a. Find the latest estimates of the revenue loss to the Treasury that is attributable to this rule. b....

-

The risk for real estate can be viewed as derived demand. If this is the case, the risk of real estate can be estimated from the underlying business it supports. Under this view, what would be the...

-

9.1. (10 points) What is the best value for k according to the output of KNN? Paste the KNN plot in the space below. 9.2. (10 points) Create the confusion matrix based on test data: Predict ed 0 1...

-

Department -name: String +getName(): String +setName(n: String) 1.." manage Company -name: String +getName(): String +setName(n: String) 1 managedBy Employee -name: String -title: String +getName():...

-

Snow Company issues 1 5 , 0 0 0 shares of $ 5 par common stock. Later in the year, Snow Company purchases 6 0 0 of their shares from the market and pays $ 1 0 for each share. In the entry to record...

-

(a) For Scenario 1 (X acquires Z on 1 January 2024), apply the appropriate accounting rules in SFRS(I) 1-21 to translate Z Cos individual financial statements (statement of profit or loss and other...

-

Maju Bhd is a trading company and has two types of inventories, namely Model Q1 and Model A2. Maju Bhd just hired Mr. Radhi as an assistant to the inventory controller. As a start, Mr. Radhi reviewed...

-

The discrepancies between p-values and Bayes posterior probabilities are not as dramatic in the one-sided problem, as is discussed by Casella and Berger (1987) and also mentioned in the Miscellanea...

-

Which provision could best be justified as encouraging small business? a. Ordinary loss allowed on $ 1244 stuck. b. Percentage depletion. c. Domestic production activates deductions. d. Interest...

-

If a taxpayer sells property for cash, the amount realized consists of the net proceeds from the sale. For each of the following, indicate the effect on the amount realized: a. The property is sold...

-

Sheila sells land to Elane, her sister, for the fair market value of $40,000. Six months later when the land is worth $45,000, Elane gives it to Jacob, her son. (No gift tax resulted.) Shortly...

-

Abby's home had a basis of $360,000 ($160,000 attributable to the land) and a fair market value of $340,000 ($155,000 attributable to the land) when she converted 70% of it to business use by opening...

-

You learned about Volkswagen's ethical dilemma when it developed the so - called clean diesel engine. For your discussion this week, select a company who had a similar ethical situation and address...

-

Test marketing is a step in the new product development process. In the chapter it was stated that some marketers see test marketing as an essential step, almost a mandatory step. Other marketers see...

-

What does it take to create completely new innovative organizations, and what are some examples of these?

Study smarter with the SolutionInn App