Marvin exchanged real property used for his printing business for new real property. The adjusted basis of

Question:

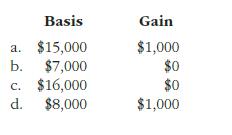

Marvin exchanged real property used for his printing business for new real property. The adjusted basis of the real property he gave up was $15,000. The new real property had a fair market value of $8,000, and Marvin received $8,000 in cash. What is Marvin’s basis in the new real property, and how much gain must Marvin recognize on the transaction?

Transcribed Image Text:

Basis Gain a. $15,000 b. $7,000 c. $16,000 d. $8,000 $1,000 $0 $0 $1,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (15 reviews)

To determine Marvins basis in the new real property and the amount of gain he must recognize we need ...View the full answer

Answered By

Maurat Ivan

I have been working in the education and tutoring field for the past five years, and have gained a wealth of experience and knowledge in this area. I have a bachelor's degree in education, and have completed additional coursework in teaching and tutoring.

In my previous roles, I have worked as a teacher in both private and public schools, teaching a variety of subjects including math, science, and English. I have also worked as a private tutor, providing one-on-one tutoring to students in need of additional support and guidance.

In my current role, I work as an online tutor, providing virtual tutoring services to students around the world. I have experience using a variety of online tutoring platforms and technologies, and am comfortable working with students of all ages and skill levels.

I am passionate about helping students succeed and reach their full potential, and I believe that my education and tutoring experience make me an excellent candidate for a tutoring job at SolutionInn. I am confident that my knowledge, skills, and experience will enable me to provide top-quality tutoring services to students on the SolutionInn platform.

0.00

0 Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2022 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357519431

25th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young, David M. Maloney

Question Posted:

Students also viewed these Business questions

-

A printing press priced at a fair market value of $300,000 is acquired in a transaction that has commercial substance by trading in a similar press and paying cash for the difference between the...

-

A printing press priced at a fair market value of $400,000 is acquired in a transaction that has commercial substance by trading in a similar press and paying cash for the difference between the...

-

A printing press priced at a fair market value of $275,000 is acquired in a transaction that has commercial substance by trading in a similar press and paying cash for the difference between the...

-

Although epoxides are always considered to have their oxygen atom as part of a threemembered ring, the prefix epoxy in the IUPAC system of nomenclature can be used to denote a cyclic ether of various...

-

Discuss consumption subcultures, including brand and online communities and their importance for marketing.

-

Katara Enterprises distributes a single product whose selling price is $36 and whose variable cost is $24 per unit. The companys monthly fixed expense is $12,000. Required: 1. Prepare a...

-

Show that the variance of the $i^{\text {th }}$ run in a $2^{3}$ design with two replications is \[\frac{\left(y_{i 1}-y_{i 2} ight)^{2}}{2}\] where $y_{i j}$ is $j^{\text {th }}$ observation in...

-

Determine the moments of inertia Iu , Iv and the product of inertia Iuv for the beam's cross-sectional area. Given: = 45 deg a = 8 in b = 2 in c = 2 in d = 16 in -a b'b

-

Image transcription text 1. A cylindrical specimen of cold-worked copper (see Fig. below) has experienced a ductility of 25%EL. If its cold worked radius is 10 mm, what was its radius before...

-

a. Return to the previous problem, and compute the value of Better Mousetraps for assumed sustainable growth rates of 6% through 9%, in increments of .5%. b. Compute the percentage change in the...

-

Since the first bitcoin transaction in 2009, the number of virtual currencies has grown to over 1,500 and some taxpayers trade the currencies multiple times each day (i.e., like a day trader). Find a...

-

Akiko, a single taxpayer, incurred higher-than-expected expenses in her active business in 2021. In addition, the economy moved into a mild recession, so her revenues were lower than in last year....

-

According to the Arizona State University Enrollment Summary, a frequency distribution for the number of undergraduate students attending Arizona State University (ASU) in the Fall 2012 semester, by...

-

Use the adult data set at the book series website for the following exercises. Use cluster membership as a further input to a CART decision tree model for classifying income. How important is...

-

A CPU produces the following sequence of read addresses in hexadecimal: 54, 58, 104, 5C, 108, 60, F0, 64, 54, 58, 10C, 5C, 110, 60, F0, 64. Supposing that the cache is empty to begin with, and...

-

A virtual memory system uses 4 KB pages, 64-bit words, and a 48-bit virtual address. A particular program and its data require 4263 pages. (a) What is the minimum number of page tables required? (b)...

-

Obtain the 1s and 2s complements of the following unsigned binary numbers: 10011100, 10011101, 10101000, 00000000, and 10000000.

-

The beds below an angular unconformity have an attitude of 334, 74W, and those above 030E, 54NW. What was the attitude of the older beds while the younger beds were being deposited?

-

Show that the standard basis vectors e1, e2, e3 form an orthogonal basis with respect to the weighted inner product (v, w) = v1 w1 + 2 u2 w2 + 3 v3 w3 on R3. Find an orthonormal basis for this inner...

-

The value of a share of common stock depends on the cash flows it is expected to provide, and those flows consist of the dividends the investor receives each year while holding the stock and the...

-

Assume the same facts as in Problem 1, except that George is a C corporation rather than an individual and is in the 34% marginal tax bracket. Which investment strategy would maximize George, Inc.s...

-

Assume the same facts as in Problem 1, except that George is a C corporation rather than an individual and is in the 34% marginal tax bracket. Which investment strategy would maximize George, Inc.s...

-

Mason performs services for Isabella. In determining whether Mason is an employee or an independent contractor, comment on the relevance of each of the factors listed below. a. Mason performs...

-

During the fall season, a retailer determined that in order to meet the next season's planned sales, the total amount of merchandise required next season was $360,000 at retail, with an initial...

-

Explore the role of collateralized debt obligations (CDOs) and collateralized loan obligations (CLOs) in securitizing and tranched collateralized credit exposures. How do structured finance vehicles,...

-

The faculty members from a local school voted to determine the winner of the "Student of the Year" award. The candidates were Ivanna, Tony, and Michael. The voting ballots are summarized in the...

Study smarter with the SolutionInn App