John Benson, age 40, is single. His Social Security number is 111-11-1111, and he resides at 150

Question:

John has a 5-year-old child, Kendra, who lives with her mother, Katy. John pays alimony of $6,000 per year to Katy and child support of $12,000. The $12,000 of child support covers 65% of Katy€™s costs of rearing Kendra. Kendra€™s Social Security number is 123-45-6789, and Katy€™s is 123-45-6788.

John€™s mother, Sally, lived with him until her death in early September 2017. He incurred and paid medical expenses for her of $12,900 and other support payments of $11,000. Sally€™s only sources of income were $5,500 of interest income on certificates of deposit and $5,600 of Social Security benefits, which she spent on her medical expenses and on maintenance of John€™s household. Sally€™s Social Security number was 123-45-6787.

John is employed by the Highway Department of the State of Louisiana in an executive position. His salary is $95,000. The appropriate amounts of Social Security tax and Medicare tax were withheld. In addition, $9,500 was withheld for Federal income taxes, and $4,000 was withheld for state income taxes.

In addition to his salary, John€™s employer provides him with the following fringe benefits:

€¢ Group term life insurance with a maturity value of $95,000. The cost of the premiums for the employer was $295.

€¢ Group health insurance plan. John€™s employer paid premiums of $5,800 for his coverage. The plan paid $2,600 for John€™s medical expenses during the year.

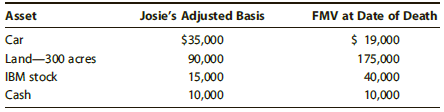

Upon the death of his aunt Josie in December 2016, John, her only recognized heir, inherited the following assets:

Three months prior to her death, Josie gave John a mountain cabin. Her adjusted basis for the mountain cabin was $120,000, and the fair market value was $195,000.

No gift taxes were paid.

During the year, John had the following transactions:

€¢ On February 1, 2017, he sold for $45,000 Microsoft stock that he inherited from his father four years ago. His father€™s adjusted basis was $49,000, and the fair market value at the date of the father€™s death was $41,000.

€¢ The car John inherited from Josie was destroyed in a wreck on October 1, 2017. He had loaned the car to Katy to use for a two-week period while the engine in her car was being replaced. Fortunately, neither Katy nor Kendra was injured. John received insurance proceeds of $16,000, the fair market value of the car on October 1, 2017.

€¢ On December 28, 2017, John sold the 300 acres of land to his brother, James, for its fair market value of $160,000. James planned on using the land for his dairy farm.

Other sources of income for John were as follows:

Dividend income (qualified dividends) ................................ $ 3,500

Interest income:

Guaranty Bank ........................................................................ 1,000

City of Kentwood water bonds ............................................. 2,000

Award from state of Louisiana for outstanding

suggestion for highway beautification .................................. 10,000

Potential itemized deductions for John, in addition to items already mentioned, were as follows:

Property taxes paid on his residence and cabin ........................... $7,000

Property taxes paid on personalty .................................................. 3,500

Estimated Federal income taxes paid ............................................. 3,000

Charitable contributions ................................................................... 4,500

Mortgage interest on his residence ................................................. 7,200

Orthodontic expenses for Kendra ................................................... 4,000

Part 1€”Tax Computation

Compute John€™s net tax payable or refund due for 2017.

Part 2€”Tax Planning

Assume that rather than selling the land to James, John is considering leasing it to him for $12,000 annually with the lease beginning on October 1, 2017. James would prepay the lease payments through December 31, 2017. Thereafter, he would make monthly lease payments at the beginning of each month. What effect would this have on John€™s 2017 tax liability? What potential problem might John encounter? Write a letter to John in which you advise him of the tax consequences of leasing versus selling. Also prepare a memo for the tax files.

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

South Western Federal Taxation Individual Income Taxes 2018

ISBN: 9781337385893

41st Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young, Nellen