On September 18, 2019, Gerald received land and a building from Frank as a gift. No gift

Question:

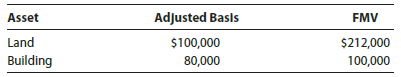

On September 18, 2019, Gerald received land and a building from Frank as a gift. No gift tax was paid on the transfer. Frank?s records show the following:

a. Determine Gerald?s adjusted basis for the land and building.

b. Assume instead that the fair market value of the land was $87,000 and that of the building was $65,000. Determine Gerald?s adjusted basis for the land and building.

Transcribed Image Text:

Adjusted Basls Asset FMV Land $212,000 100,000 $100,000 80,000 Building

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (6 reviews)

a Geralds basis in the assets received carries over f...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2020 Comprehensive

ISBN: 9780357109144

43rd Edition

Authors: David M. Maloney, William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman

Question Posted:

Students also viewed these Business questions

-

On September 18, 2015, Gerald received land and a building from Frank as a gift. Frank's adjusted basis and the fair market value at the date of the gift are as follows: Asset Adjusted Basis FMV...

-

On September 18, 2017, Gerald received land and a building from Frank as a gift. Frank's adjusted basis and the fair market value at the date of the gift are as follows: Asset _____________ Adjusted...

-

On September 18, 2018, Gerald received land and a building from Frank as a gift. Frank's adjusted basis and the fair market value at the date of the gift are as follows: No gift tax was paid on the...

-

The FBI Standard Survey of Crimes shows that for about 80% of all property crimes (burglary, larceny, car theft, etc.), the criminals are never found and the case is never solved (Source: True Odds,...

-

What are some of the advantages and limitations of the sodium silicate-CO2 process?

-

The spool has weight W s and radius of gyration k O . If the block B has weight W b and a force P is applied to the cord, determine the speed of the block at time t starting from rest. Neglect the...

-

The following data are for Marvin Department Store. The account balances (in thousands) are for 2017. 1. Compute (a) the cost of goods purchased and (b) the cost of goods sold. 2. Prepare the income...

-

On January 1, 2012, Barwood Corporation granted 5,000 options to executives. Each option entitles the holder to purchase one share of Barwoods $5 par value common stock at $50 per share at any time...

-

17. In many cases, a worker's hourly wage depends on the number of hours worked. If a certain number of hours is reached, the pay rate beyond that point increases. When working beyond a certain...

-

a. A technological breakthrough raises a country's total factor productivity A by 10%. Show how this change affects the graphs of both the production function relating output to capital and the...

-

Roberto has received various gifts over the years and has decided to dispose of several of these assets. What is the recognized gain or loss from each of the following transactions, assuming that no...

-

As sole heir, Dazie receives all of Marys property (adjusted basis of $11,400,000 and fair market value of $13,820,000). Six months after Marys death, the fair market value is $13,835,000. a. Can the...

-

(a) If a0, a1, a2, a3 is a list of four real numbers, what is 3i=1(a1 - a1-1)? (b) Given a list--a0, a1, a2,...,an--of n + 1 real numbers, where n is a positive integer, determine ni=1 (c) Determine...

-

What are some situations in which you might experience stress that interferes with your ability to be emotionally available and engaged with others? What are some steps you can take to manage your...

-

What ethical considerations and accountability mechanisms should leaders integrate into their vision communication strategies to ensure transparency, inclusivity, and alignment with organizational...

-

Last year, Sylvia declared a $12,500 taxable capital gain on her income tax return. This year, she realized a capital gain of $10,000 and a capital loss of $18,000 before the end of the year. What is...

-

Calculate Capital Acquisition Ratio for 2017, 2018, 2019 (round to hundredths) The TJX Companies, Inc. CONSOLIDATED STATEMENTS OF INCOME Amounts in thousands except per share amounts Net sales Cost...

-

After analyzing the case study, the discuss the following questions from the operations management perspective. 1. What is the overall goal of aggregate production planning (APP)? 2. How might...

-

Explain how the two methods of cash distribution work, and describe their impact on shareholders. Does everyone always receive cash? If not are some stockholders left out?

-

A heat engine has a heat input of 3 Ã 104 Btu/h and a thermal efficiency of 40 percent. Calculate the power it will produce, in hp. Source 3 x 10 Btu/h 40% HE Sink

-

Marie and Ethan form Roundtree Corporation with the transfer of the following. Marie performs personal services for the corporation with a fair market value of $80,000 in exchange for 400 shares of...

-

Marie and Ethan form Roundtree Corporation with the transfer of the following. Marie performs personal services for the corporation with a fair market value of $80,000 in exchange for 400 shares of...

-

Under what circumstances will gain and/or loss be recognized on a 351 transfer?

-

The risk treatment option of reassigning accountability for a risk to another entity or organization is known as?

-

What are the molecular mechanisms underlying genomic imprinting, and how do parent-of-origin-specific epigenetic marks regulate the expression of imprinted genes during development and beyond?

-

How do leaders vary by the roles they perform and the amount of power they possess?

Study smarter with the SolutionInn App