BDD Partnership is a service-oriented partnership that has three equal general partners. One of them, Barry Evans,

Question:

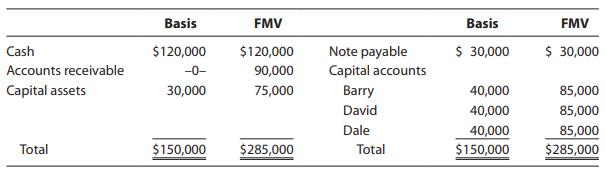

- BDD Partnership is a service-oriented partnership that has three equal general partners. One of them, Barry Evans, sells his interest to another partner, Dale Allen, on December 31 (the last day of the current tax year), for $90,000 of cash and the assumption of Barry’s share of partnership liabilities. (Liabilities are shared equally by the partners.) Immediately before the sale (after reflecting operations for the year), the partnership’s cash basis balance sheet is as shown below. Assume that the capital accounts before the sale reflect the partners’ bases in their partnership interests, excluding liabilities. The payment exceeds the stated fair market value of the assets because of goodwill that is not recorded on the books.

a. What is the total amount realized by Barry on the sale?

b. How much, if any, ordinary income must Barry recognize on the sale?

c. How much capital gain must Barry report?

d. What is Dale’s basis in the partnership interest acquired?

e. Refer to Reg. § 1.751–1(a)(3). What information is the seller required to provide? Draft a statement that meets these requirements.

PartnershipA legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted: