John Parsons (123-45-6781) and George Smith (123-45-6782) are 70% and 30% owners, respectively, of Premium, Inc. (11-1111111),

Question:

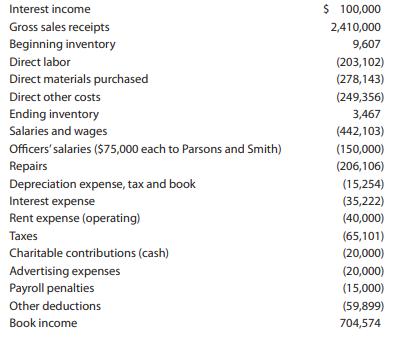

John Parsons (123-45-6781) and George Smith (123-45-6782) are 70% and 30% owners, respectively, of Premium, Inc. (11-1111111), a candy company located at 1005 16th Street, Cut and Shoot, TX 77303. Premium’s S election was made on January 15, 2011, its date of incorporation. The following information was taken from the company’s 2018 income statement.

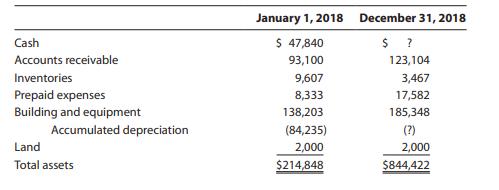

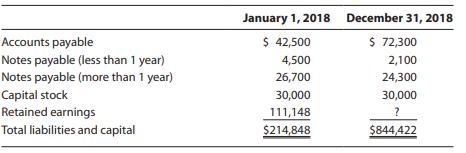

A comparative balance sheet follows.

Premium’s accounting firm provides the following additional information.

Distributions to shareholders.............................................................$100,000

Beginning balance, Accumulated adjustments account.............111,148

Using the preceding information, prepare a Form 1120S and Schedule K–1s for John Parsons and George Smith, 5607 20th Street, Cut and Shoot, TX 77303. Do not complete the Forms 1125–A, 1125–E, and 4562. If any information is missing, make realistic assumptions. Suggested software: ProConnect Tax Online.

Step by Step Answer:

South-Western Federal Taxation 2020 Comprehensive

ISBN: 9780357109144

43rd Edition

Authors: David M. Maloney, William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman