Kay, who is not a real estate dealer, sold an apartment house to Polly during the current

Question:

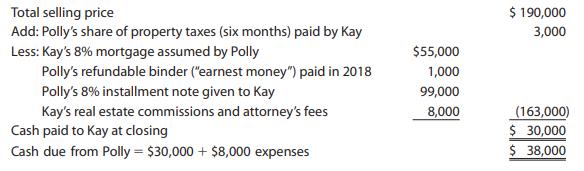

Kay, who is not a real estate dealer, sold an apartment house to Polly during the current year (2019). The closing statement for the sale is as follows.

During 2019, Kay collected $9,000 in principal on the installment note and $2,000 of interest. Kay’s basis in the property was $110,000 [$125,000 $15,000 2 (depreciation)]. The Federal rate is 6%.

a. Compute the following.

1. Total gain.

2. Contract price.

3. Payments received in the year of sale.

4. Recognized gain in the year of sale and the character of such gain.

(Think carefully about the manner in which the property taxes are handled before you begin your computations.)

b. Same as parts (a)(2) and (3), except that Kay’s basis in the property was $35,000.

Step by Step Answer:

South-Western Federal Taxation 2020 Comprehensive

ISBN: 9780357109144

43rd Edition

Authors: David M. Maloney, William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman