Question:

Sam Upchurch, a single taxpayer, acquired stock in Hummer Corporation that qualified as a small business corporation under § 1244 at a cost of $100,000 three years ago. He sells the stock for $10,000 in the current tax year.

a. How will the loss be treated for tax purposes?

b. Assume instead that Sam sold the stock to his sister, Kara Upchurch, a few months after it was acquired for $100,000 (its fair market value). If Kara sells the Hummer stock for $60,000 in the current year, how should she treat the loss for tax purposes?

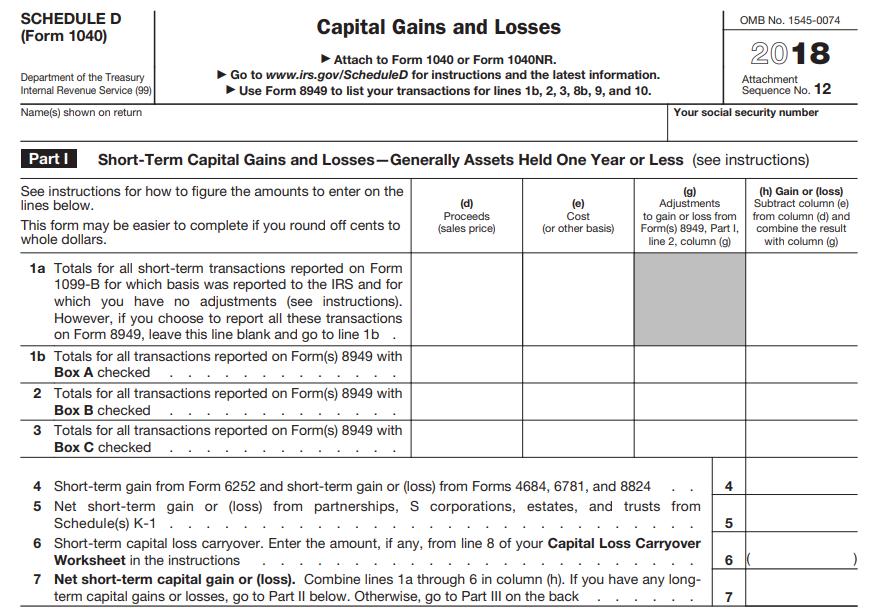

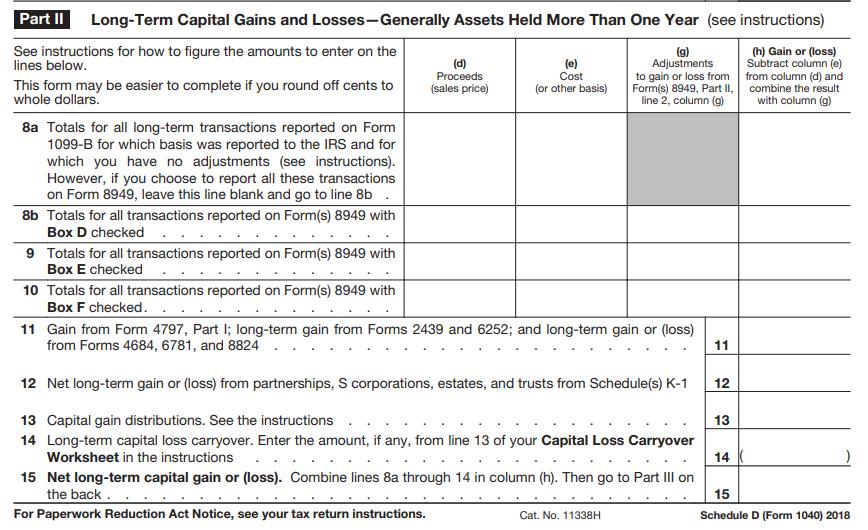

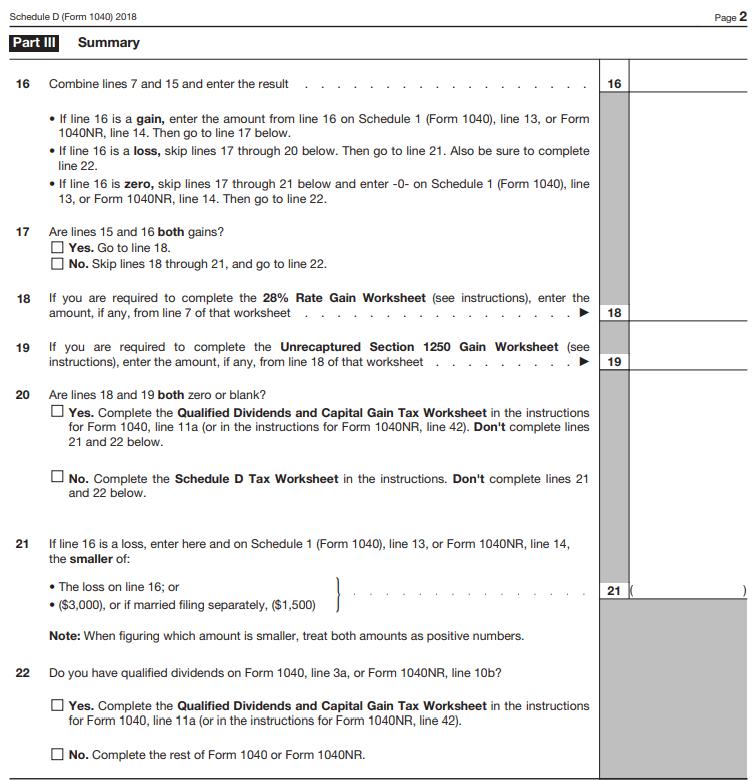

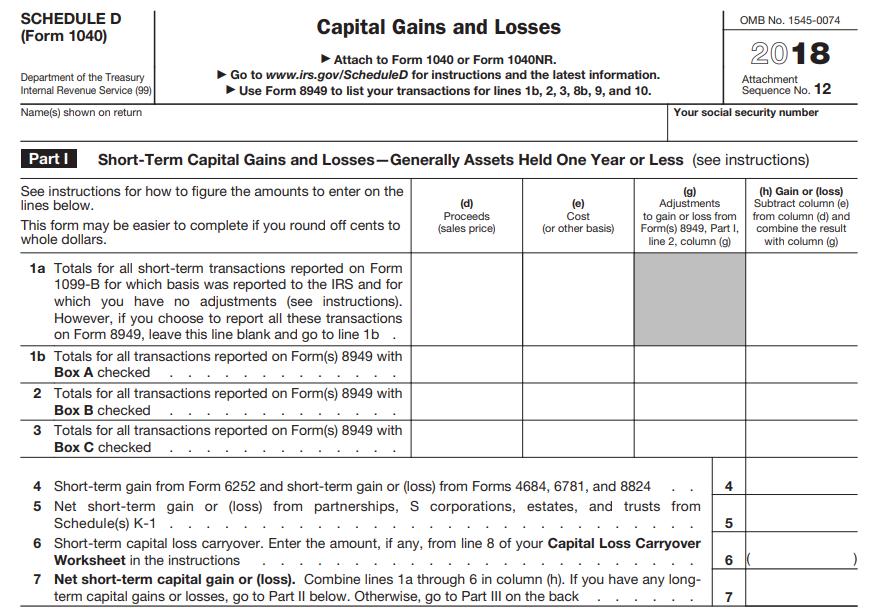

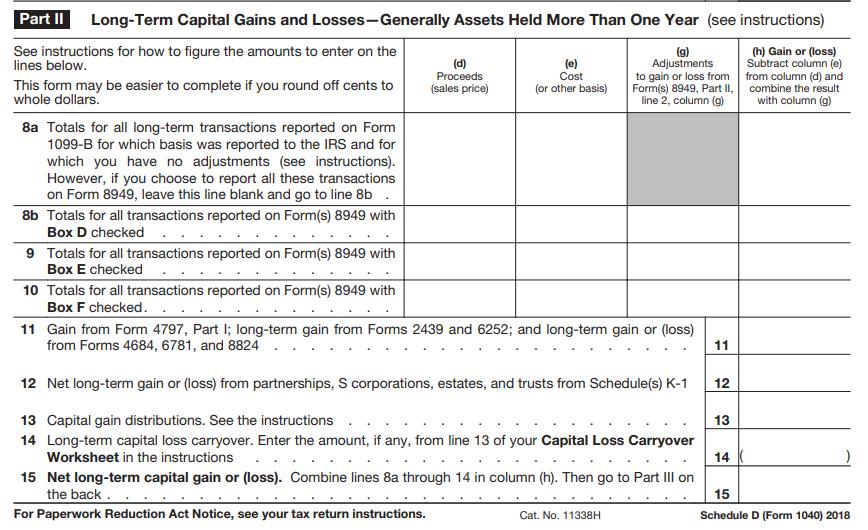

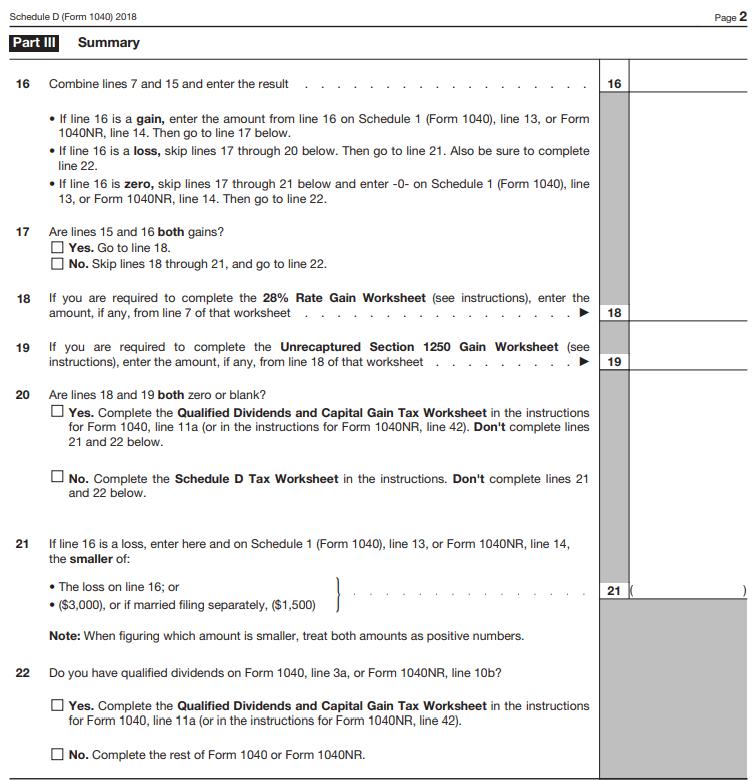

c. Enter the results of this transacton to Kara on Form 1040, Schedule D (p. 1) (use the most current form available). Her Social Security number is 123-45-6789. Assume that relevant facts from the transaction initially had been shown on Form 8949 with Box F checked.

Schedule D

Transcribed Image Text:

SCHEDULE D OMB No. 1545-0074 Capital Gains and Losses (Form 1040) 2018 Attach to Form 1040 or Form 1040NR. Go to www.irs.gov/ScheduleD for instructions and the latest information. Department of the Treasury Internal Revenue Service (99) Attachment Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. Sequence No. 12 Name(s) shown on return Your social security number PartI Short-Term Capital Gains and Losses-Generally Assets Held One Year or Less (see instructions) See instructions for how to figure the amounts to enter on the lines below. (d) Proceeds (sales price) (e) Cost (or other basis) (9) Adjustments to gain or loss from Form(s) 8949, Part I, line 2, column (g) (h) Gain or (loss) Subtract column (e) from column (d) and combine the result This form may be easier to complete if you round off cents to whole dollars. with column (g) 1a Totals for all short-term transactions reported on Form 1099-B for which basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 1b 1b Totals for all transactions reported on Form(s) 8949 with Box A checked 2 Totals for all transactions reported on Form(s) 8949 with Box B checked 3 Totals for all transactions reported on Form(s) 8949 with Box C checked 4 Short-term gain from Form 6252 and short-term gain or (loss) from Forms 4684, 6781, and 8824 4 5 Net short-term gain or (loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1. 6 Short-term capital loss carryover. Enter the amount, if any, from line 8 of your Capital Loss Carryover Worksheet in the instructions 6 ( 7 Net short-term capital gain or (loss). Combine lines 1a through 6 in column (h). If you have any long- term capital gains or losses, go to Part II below. Otherwise, go to Part III on the back 7