In a cross-section study of the determinants of economic growth (National Bureau of Economic Research, Macroeconomic Annual,

Question:

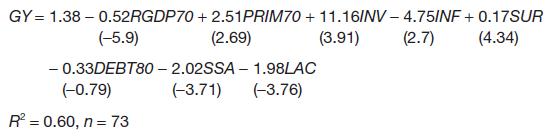

In a cross-section study of the determinants of economic growth (National Bureau of Economic Research, Macroeconomic Annual, 1991), Stanley Fischer obtained the following regression equation:

where

GY: growth per capita, 1970–85

RGDP: real GDP per capita, 1970

PRIM70: primary school enrolment rate, 1970

INV: investment/GNP ratio

INF: inflation rate

SUR: budget surplus/GNP ratio

DEBT80: foreign debt/GNP ratio

SSA: dummy for sub-Saharan Africa

LAC: dummy for Latin America and the Caribbean

(a) Explain why each variable is included. Does each have the expected sign on its coefficient? Are there any variables which are left out, in your view?

(b) If a country were to increase its investment ratio by 0.05, by how much would its estimated growth rate increase?

(c) Interpret the coefficient on the inflation variable.

(d) Calculate the F statistic for the overall significance of the regression equation. Is it significant?

(e) What do the SSA and LAC dummy variables tell us?

Step by Step Answer:

Statistics For Economics Accounting And Business Studies

ISBN: 978027368308

4th Edition

Authors: Michael Barrow