A non-profit organization plans to offer a life insurance service. Participants agree to a five-year contract in

Question:

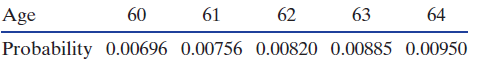

For example, on her 60th birthday a woman will have a 0.82% chance of dying at the age of 62.

(a) Let X be the organization€™s total profit, in dollars, five years after selling a contract to a woman on her 60th birthday. Write the probability distribution of X, where the values of X are given in terms of the yearly fee c.

(b) Write the mean of X in terms of c.

(c) What yearly fee should the organization charge 60-year-old women if they hope to break even? (The organization can expect to break even if they have a mean profit of $0.)

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Statistics Unlocking The Power Of Data

ISBN: 9780470601877

1st Edition

Authors: Robin H. Lock, Patti Frazer Lock, Kari Lock Morgan, Eric F. Lock, Dennis F. Lock

Question Posted: