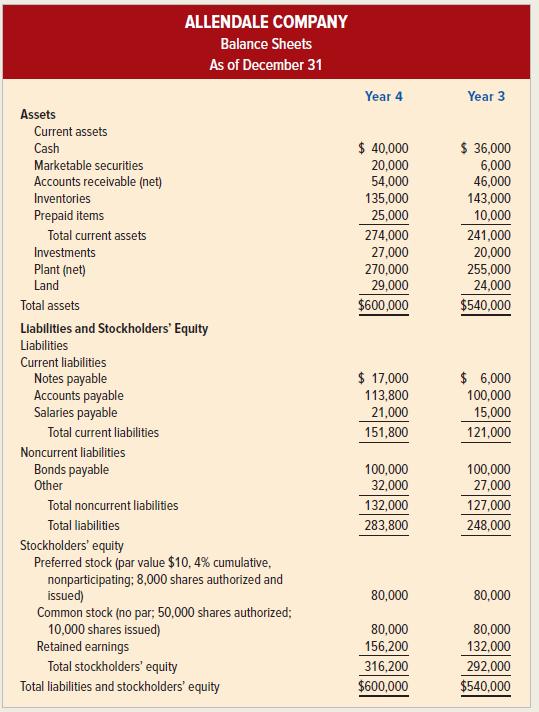

Use the financial statements for Allendale Company from Problem 9-17A to calculate the following ratios for Year

Question:

Use the financial statements for Allendale Company from Problem 9-17A to calculate the following ratios for Year 4 and Year 3:

a. Working capital.

b. Current ratio.

c. Quick ratio.

d. Receivables turnover (beginning receivables at January 1, Year 3, were $47,000).

e. Average days to collect accounts receivable.

f. Inventory turnover (beginning inventory at January 1, Year 3, was $140,000).

g. Number of days to sell inventory.

h. Debt-to-assets ratio.

i. Debt-to-equity ratio.

j. Number of times interest was earned.

k. Plant assets to long-term debt.

l. Net margin.

m. Turnover of assets.

n. Return on investment.

o. Return on equity.

p. Earnings per share.

q. Book value per share of common stock.

r. Price-earnings ratio (market price per share: Year 3, $11.75; Year 4, $12.50).

s. Dividend yield on common stock.

Problem 9-17A

Step by Step Answer:

Survey Of Accounting

ISBN: 9781260575293

6th Edition

Authors: Thomas Edmonds, Christopher Edmonds, Philip Olds