Mulkey Development Company has two competing projects: an office building and a condominium complex. Both projects have

Question:

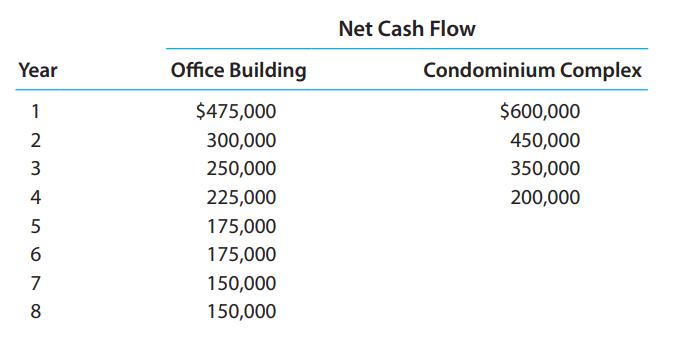

Mulkey Development Company has two competing projects: an office building and a condominium complex. Both projects have an initial investment of $1,000,000. The net cash flows estimated for the two projects are as follows:

The estimated residual value of the office building at the end of Year 4 is $450,000.

Determine which project should be favored, comparing the net present values of the two projects and assuming a minimum rate of return of 15%. Use the table of present values in the chapter.

Transcribed Image Text:

Net Cash Flow Year Office Building Condominium Complex 1 $475,000 $600,000 2 300,000 450,000 3 250,000 350,000 4 225,000 200,000 175,000 175,000 7 150,000 8 150,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

Office Building Present Value Year of 1 at 15 Net Cash Flow Present Value of Net Cash Flow 1 0870 47...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Healey Development Company has two competing projects: an office building and a condominium complex. Both projects have an initial investment of $2,000,000. The net cash flows estimated for the two...

-

Lordsland Development Company has two competing projects: an apartment complex and an office building. Both projects have an initial investment of $720,000. The net cash flows estimated for the two...

-

Lordsland Development Company has two competing projects: an apartment complex and an office building. Both projects have an initial investment of $720,000. The net cash flows estimated for the two...

-

Find the magnitude and direction of the electric field strength at the point P due to the point charges at A and B as shown in the Figure 1. (k = 9 x 10 Nm/C) +2 C 10 cm A 10 cm Figure 1 B -8 C (5...

-

$85 per hour for loading/unloading service $70 per hour for packing/unpacking service $5 per mile for truck rental We Move U charges for moving according to the rate schedule shown. Nicky is moving a...

-

After failing to complete a merger in the three prior attempts noted in the case, why should the proposed transaction be successful this time? What is different? Is this a good or a bad thing?

-

Saturated steam at \(356 \mathrm{~K}\) condenses on a vertical tube of diameter \(5 \mathrm{~cm}\) whose surface is maintained at \(340 \mathrm{~K}\). Find the height at which the flow becomes wavy....

-

Northern Communications has the following stockholders' equity on December 31, 2018: Requirements 1. Assuming the preferred stock is cumulative, compute the amount of dividends to preferred...

-

Carbata Company manufactures low-cost, basic tool kits in bulk. Below is the latest information for last month's production. Inventory on September 1 96 Complete Units Started Costs Added in...

-

Prepare the journal by recording the following transactions 3-Dec Mrs. Veena started business by introducing cash Rs. 5000 and Rs 500000 as transfer from her saving bank account in the business 5-Dec...

-

Kentucky Grill has computed the net present value for capital expenditures for the Somerset and Whitley City locations using the net present value method. Relevant data related to the computation are...

-

West Coast Industries Inc. wishes to evaluate three capital investment projects by using the net present value method. Relevant data related to the projects are summarized as follows: Instructions 1....

-

Gentry Co. wholesales bathroom fixtures. During the current fiscal year, Gentry Co. received the following notes: Instructions 1. Determine for each note (a) The due date and (b) The amount of...

-

During Y2, Aylmer Inc. purchased the following investments for cash but incorrectly recorded them as "Other Investments" on the balance sheet. Aylmer follows IFRS. January 1, Y2 March 31, Y2 April...

-

Kenny's Kebabs is a food stand that sells kebabs. The table below lists Kenny's production costs per hour. A. Complete the table above. B. If the price of kebabs is $10, what is the profit-maximizing...

-

Read each definition on the next page and then write the number of that definition in the blank beside the appropriate term it defines. _____ Recognition____ Unearned revenue _ ___...

-

21. The document necessary to file to form an LLC is called Corporation it's called_ a. Articles of Incorporation, Articles of Corporate Formation b. Articles of Organization, Articles of...

-

Galaxy Inc. reported net income for accounting purposes of $1,130,000. In calculating this amount, the following items were deducted: 1- Income tax expense 2- Interest expense (Includes $7,000 of...

-

Why do you think Borders introduction of e-readers branded by other companies was not as successful as Amazon's Kindle, Barnes & Noble's Nook, or Apple's iPad?

-

Prepare a stock card using the following information A company is registered for GST which it pays quarterly, assume GST was last paid on the 30th of June 2019. It uses weighted average cost...

-

A former chairman, CFO, and controller of Donnkenny, Inc., an apparel company that makes sportswear for Pierre Cardin and Victoria Jones, pleaded guilty to financial statement fraud. These managers...

-

The procedures used for over-the-counter receipts are as follows. At the close of each days business, the sales clerks count the cash in their respective cash drawers, after which they determine the...

-

Victor Blackmon works at the drive-through window of Buffalo Bobs Burgers. Occasionally, when a drive-through customer orders, Victor fills the order and pockets the customers money. He does not ring...

-

Match the statements to the protocols * faster more reliable used for sending data TCP UDP both

-

1. Should managers try to maximize market value of equity or to maximize the accounting value of equity in the balance sheet? Why? 2. What is your understanding of the relationship between risk and...

-

How much risk is appropriate for a government-run annuity system? Is there an appropriate risk-return calculation to be made? Is Social Security risk free? What about political risk?

Study smarter with the SolutionInn App