The following information about the payroll for the week ended September 15 was obtained from the records

Question:

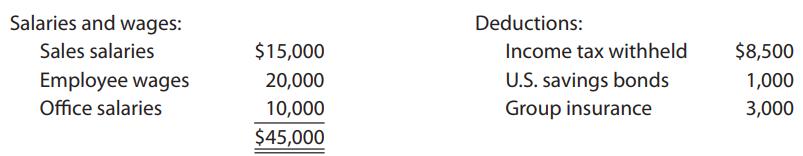

The following information about the payroll for the week ended September 15 was obtained from the records of Simkins Mining Co.:

Tax rates assumed:

FICA tax, 7.5% of employee annual earnings

State unemployment (employer only), 4.2%

Federal unemployment (employer only), 0.8%

Instructions

1. For the September 15 payroll, determine the employee FICA tax payable.

2. Illustrate the effect on the accounts and financial statements of paying the September 15 payroll.

3. Determine the following amounts for the employer payroll taxes related to the September 15 payroll:

(a) FICA tax payable

(b) state unemployment tax payable

(c) federal unemployment tax payable. Assume all salaries and wages are subject to statement and federal unemployment taxes.

4. Illustrate the effect on the accounts and financial statements of recording the liability for the September 15 employer payroll taxes.

Step by Step Answer: