West Coast Industries Inc. wishes to evaluate three capital investment projects by using the net present value

Question:

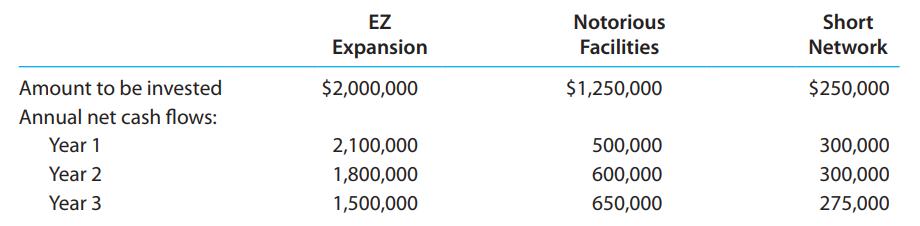

West Coast Industries Inc. wishes to evaluate three capital investment projects by using the net present value method. Relevant data related to the projects are summarized as follows:

Instructions

1. Assuming that the desired rate of return is 20%, prepare a net present value analysis for each project. Use the present value of $1 table appearing in this chapter.

2. Determine a present value index for each project. Round to two decimal places.

3. Which project offers the largest amount of present value per dollar of investment? Explain.

EZ Notorious Short Expansion Facilities Network Amount to be invested $2,000,000 $1,250,000 $250,000 Annual net cash flows: Year 1 2,100,000 500,000 300,000 Year 2 1,800,000 600,000 300,000 Year 3 1,500,000 650,000 275,000

Step by Step Answer:

1 EZ Expansion Present Value Net Cash Present Value of Year of 1 at 20 Flow Net Cash Flow 1 0833 210...View the full answer

Related Video

NPV stands for \"Net Present Value,\" which is a financial concept used to determine the value of an investment or project. It measures the difference between the present value of cash inflows and the present value of cash outflows over a given period of time, using a specific discount rate. To calculate the NPV of an investment, you need to first estimate the cash inflows and outflows associated with the investment, and then discount them back to their present values using a discount rate. The discount rate represents the cost of capital or the expected rate of return required by investors. The formula for calculating NPV is: NPV = sum of (cash inflows / (1 + discount rate)^t) - sum of (cash outflows / (1 + discount rate)^t) Where: Cash inflows: the expected cash received from the investment Cash outflows: the expected cash paid out for the investment Discount rate: the required rate of return or the cost of capital t: the time period in which the cash flow occurs If the NPV is positive, it means that the investment is expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a good investment. If the NPV is negative, it means that the investment is not expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a bad investment.

Students also viewed these Business questions

-

Atlantic Coast Railroad Company wishes to evaluate three capital investment proposals by using the net present value method. Relevant data related to the proposals are summarized as follows:...

-

Soares Industries Inc. wishes to evaluate three capital investment projects by using the net present value method. Relevant data related to the projects are summarized as follows: Instruction 1....

-

Donahue Industries Inc. wishes to evaluate three capital investment projects by using the net present value method. Relevant data related to the projects are summarized as follows: Instructions 1....

-

10. A light cord is wrapped around a wheel, R = 0.10 m and rotational inertia I about its axis and is attached to mass, m = 2 kg, see about its fixed axis and the object accelerates downward, (take g...

-

The square footage and monthly rental of 10 similar two-bedroom apartments yield the linear regression formula y = 1.165x + 615.23 where x represents the square footage of the apartment and y...

-

Why is the amount of debt in a companys capital structure important to the financial analyst? (a) Debt implies risk. (b) Debt is less costly than equity. (c) Equity is riskier than debt. (d) Debt is...

-

In 1997, Bernard Bilski and Rand Warsaw filed a patent application for a method of hedging risk in the field of commodities trading. In effect, the asserted invention was a method of protecting...

-

The contribution margin income statement of Margot Coffee for February follows: Margot Coffee sells three small coffees for every large coffee. A small coffee sells for $ 3.00, with a variable...

-

1. 49 The value of n(n+n+1) is equal to (10a) [10a-3. The value of (a + ) is n=1 48 47 46 2 1 2. If + + + + + = (2)(3) (3)(4) (4)(5) (48)(49) (49)+(50) k is equal to 3. +++++ Then 4. 5. In a...

-

Gig Harbor Boating is the wholesale distributor of a small recreational catamaran sailboat. Management has prepared the following summary data to use in its annual budgeting process: Budgeted unit...

-

Mulkey Development Company has two competing projects: an office building and a condominium complex. Both projects have an initial investment of $1,000,000. The net cash flows estimated for the two...

-

Microsoft Corporation (MSFT) reported the following data (in millions) for a recent year: Sales ..............................................$110,360 Operating income...

-

Identify and describe the six major building blocks of financial statement analysis. What is the initial step in applying the building blocks to an analysis of financial statements?

-

Create an 8 8 grayscale image consisting of a 64-character ASCII text string. Use lowercase letters only, with no whitespace or punctuation. Compress into JPEG format and decompress. How...

-

What might a server actually do with the packet loss rate data and jitter data in receiver reports?

-

Consider the example internet shown in Figure 4.30, in which sources D and E send packets to multicast group G, whose members are shaded in gray. Show the shortest path multicast trees for each...

-

Give an example of how nonpreemption in the implementation of fair queuing leads to a different packet transmission order from bitby-bit round-robin service.

-

An ISP that has authority to assign addresses from a /16 prefix (an old class B address) is working with a new company to allocate it a portion of address space based on CIDR. The new company needs...

-

Pettigrew Holdings Ltd. owns an 80-percent interest in Shortland Inc. Prepare a consolidation work sheet using the information below. Assume that the fair values of Shortland Inc.'s assets and...

-

Flicker, Inc., a closely held corporation, acquired a passive activity this year. Gross income from operations of the activity was $160,000. Operating expenses, not including depreciation, were...

-

Identify the internal control weaknesses that exist at Buffalo Bobs Burgers, and discuss what can be done to prevent this theft. Themailroom employees send all remittances and remittance advices to...

-

The actual cash received from cash sales was $36,183, and the amount indicated by the cash register total was $36,197. a. What is the amount deposited in the bank for the days sales? b. What is the...

-

The actual cash received from cash sales was $11,279, and the amount indicated by the cash register total was $11,256. a. What is the amount deposited in the bank for the days sales? b. What is...

-

1. A clothes dryer rates at 4000 W runs for 1.50 hours each day. it uses utility power at 240 V. how much current does the dryer use? 2. For the clothes dryer in the previous question, how much does...

-

A particle undergoing simple harmonic motion has a potential energy given by E/J=3(y/m) as it oscillates back and forth along the y-axis. When the y-coordinate of the particle is 0.75 m, what is the...

-

A 480-g iron pan is heated on a stove to a temperature of 130 C. The pan is then dropped into a partially-filled sink of water at 20 C. The final temperature reached by the sink and the pan is 40 C....

Study smarter with the SolutionInn App