Dannys living room furniture and his flat screen television were damaged in a fire in his home

Question:

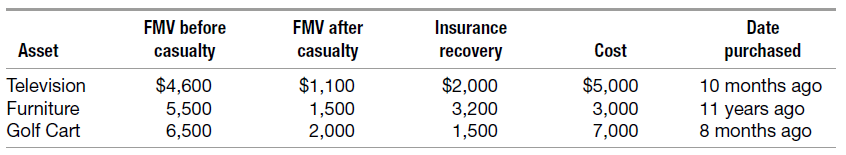

Danny’s living room furniture and his flat screen television were damaged in a fire in his home in January. In March, his golf cart was damaged in a flood. He was able to establish the following information to determine his losses on these assets.

Danny’s AGI is $37,000 before considering these casualties and he has $12,000 of other itemized deductions.

a. Determine Danny’s deductible casualty loss if the events occurred in 2017.

b. How would your answer change if these events happened in 2018?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Taxation For Decision Makers 2019

ISBN: 9781119497288

9th Edition

Authors: Shirley Dennis Escoffier, Karen A. Fortin

Question Posted: