Jose (SSN 150-45-6789) and Rosanna (SSN 123-45-7890) Martinez are a married couple who reside at 1234 University

Question:

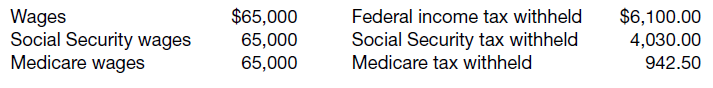

Jose (SSN 150-45-6789) and Rosanna (SSN 123-45-7890) Martinez are a married couple who reside at 1234 University Drive in Coral Gables, FL 33146. They have two children: Carmen, age 19 (SSN 234-65-4321), and Greg, age 10 (SSN 234-65-5432). Carmen is a full-time student at the local university; she lives at home and commutes to school. Jose is an architect for Deco Design Architects and is covered by his employer’s defined benefit pension plan. His Form W-2 reported the following information:

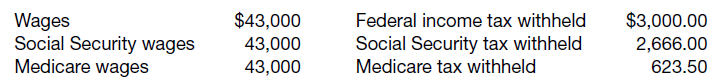

Rosanna was a loan officer at BankOne until October. Her Form W-2 reported the following information:

Rosanna’s employer does not provide any retirement plan for its employees.

Jose and Rosanna received $3,500 of interest income from BankOne and $130 of qualified dividend income on Microserf stock (reported in boxes 1a and 1b on Form 1099-DIV). Rosanna received $45 in jury duty pay in May.

The Martinez family has medical insurance that they purchase through the cafeteria plan offered by Jose’s employer (on a pre-tax basis). The annual cost of this medical insurance for the entire family was $3,600. Martinez family also paid $12,300 for qualified medical expenses for which they received no insurance reimbursements.

The Martinez family paid $9,400 in interest on their home mortgage acquired in 2015 with a principle balance of $300,000 (which Overnight Mortgage Company reported to them on Form 1098). The Martinez family also owns a vacation home in Breckenridge, Colorado, for which they paid $4,100 of mortgage interest (acquired in 2016 with a principal balance of $82,000). Other interest paid by Jose and Rosanna includes $1,100 for a loan on their personal automobile and $400 on credit cards.

The Martinez family paid real estate taxes on their principal residence of $3,500, $2,000 of real estate taxes on their vacation home and $3,200 of sales taxes during the year.

The Martinez family has the necessary documentation for the following contributions made to qualified charitable organizations: (1) Cash of $2,500 given to their church. (2) Ford stock purchased 6 years ago on March 16, at a cost of $750 was given to United Way (a qualified charitable organization located at 1 Flagler St. Miami, FL 33156) on February 22 when it had a fair market value of $1,650 (the average stock price on the date of donation).

Jose and Rosanna received a Form 1098-T reporting in box 1 the $8,000 they paid for Carmen’s tuition at Florida University (59-11223344; 111 College Road, Miami, FL 33134) where she is a sophomore. Box 8 was checked to indicate she was at least a half-time student. They also paid $750 for textbooks she needed for her classes. They want to maximize any tax benefits they can receive from the expenses they paid for Carmen’s education.

In October, Rosanna quit her job with the bank and began a consulting business. The business code is 541990. She is operating the business under her own name and rented a small office at 1234 Coral Way, Coral Gables, FL 33146. Since Rosanna began her business so late in the year, her consulting income was only $7,000. She incurred the following expenses: $475 supplies, $210 telephone, $2,200 office rent, and $325 advertising.

Rosanna contributed $2,000 to a traditional individual retirement account on December 5. This is the first time she has contributed to an IRA. Other information: They have no foreign accounts and no one in the family was ever convicted of a felony. Jose was born on April 1, 1977; Rosanna was born May 1, 1978.

Based on the information presented above, prepare a Form 1040 (married filing jointly) and any required related forms and schedules using the forms for 2017 available on the IRS website at www.irs.gov.

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Taxation For Decision Makers 2019

ISBN: 9781119497288

9th Edition

Authors: Shirley Dennis Escoffier, Karen A. Fortin