You have been assigned to compute the income tax provision for Motown Memories, Inc. (MM) as of

Question:

You have identified the following permanent differences:

- Interest income from municipal bonds: $50,000

- Nondeductible meals and entertainment expenses: $20,000

- Domestic production activities deduction (DPAD): $250,000

- Nondeductible fines: $5,000

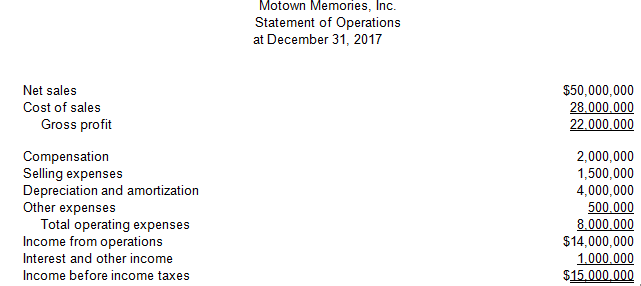

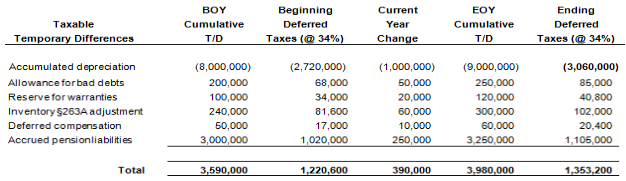

MM prepared the following schedule of temporary differences from the beginning of the year to the end of the year:

a. Compute MM€™s current income tax expense or benefit for 2017.

b. Compute MM€™s deferred income tax expense or benefit for 2017.

c. Prepare a reconciliation of MM€™s total income tax provision with its hypothetical income tax expense in both dollars and rates

Transcribed Image Text:

Motown Memories, Inc. Statement of Operations at December 31, 2017 Net sales $50,000,000 28.000.000 22.000.000 Cost of sales Gross profit Compensation Selling expenses Depreciation and amortization Other expenses Total operating expenses Income from operations 2,000,000 1,500,000 4,000,000 500.000 8.000.000 $14,000,000 1.000.000 $15.000.000 Interest and other income Income before income taxes Current Year BOY Beginning EOY Ending Тахаble Temporary Differences Cumulative T/D Deferred Cumulative T/D Deferred Taxes (@ 34%) (2,720,000) Taxes (@ 34%) Change (8,000,000) 200,000 100,000 240,000 (1,000,000) (9,000,000) 250,000 120,000 300,000 (3,060,000) Accumulated depreciation Allowance forbad debts Reservefor warranties Inventory $263A adjustment Deferred compensation 68,000 БО,000 85,000 40,800 102,000 20,400 34,000 20,000 81,600 17,000 60,000 10,000 50,000 Accrued pensionliabilities 3,250,000 3,000,000 1,020,000 250,000 1,105,000 Total 3,590,000 1,220,600 390,000 3,980,000 1,353,200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 37% (8 reviews)

a Compute MMs current income tax expense or benefit for 2017 b C...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Taxation Of Business Entities 2018 Edition

ISBN: 9781260174441

9th Edition

Authors: Brian C. Spilker, Benjamin C. Ayers, John A. Barrick, Edmund Outslay, John Robinson, Connie Weaver Ronald G. Worsham

Question Posted:

Students also viewed these Business questions

-

You have been assigned to compute the income tax provision for Tulip City Flowers Inc. (TCF) as of December 31, 2015. The company's federal income tax rate is 34 percent. The company's income...

-

Compute the income tax provision for Motown Memories Inc. (MM) as of December 31, 2019. The companys income statement for 2019 is provided below: Motown Memories Inc. Statement of Operations at...

-

As an internal auditor, you have been assigned to evaluate the controls and operation of acomputer payroll system. To test the computer systems and programs, you submit independentlycreated test...

-

Review each of the following independent sets of conditions. Required: Use AICPA sample size tables to identify the appropriate sample size for use in a statistical sampling application (ROO 5 risk...

-

An analyst recently suggested that there will be a major economic expansion that will favorably affect the prices of high-rated fixed-rate bonds, because the credit risk of bonds will decline as...

-

Atlantic Service Company was established in Moncton, New Brunswick, five years ago to provide services to the home construction industry. It has been very successful, with assets, sales, and profits...

-

A marketed asset's price \(x\) is governed by the mean reverting process where \(\eta, \theta\), and \(\sigma\) are positive constants and \(z\) is a Wiener process. (a) Let \(V(x, t)\) be a given...

-

Which portfolio is better diversified, one that contains stock in a dental supply company and a candy company or one that contains stock in a dental supply company and a dairy product company?

-

Image transcription text You encounter a split system that uses R-22 refrigerant and observe the following refrigeration parameters from the unit's control display. The unit is operating in cooling...

-

Delima Bhd is a public listed company incorporated in 2010 and is involved in the business of trading, and manufacturing pharmaceutical and health products. As at 1 January 2022, Delima Bhd has a...

-

If accounting profit is $400,000 greater than economic profit, what do implicit costs equal?

-

Carrie DLake, Reed A. Green, and Doug A. Divot share a passion for golf and decide to go into the golf club manufacturing business together. On January 2, 2017,DLake, Green, and Divot form the...

-

How will growth impact the structure of the European Central Banks (ECB) decision-making bodies?

-

A business that has found ways to use technology to outperform its rivals in the marketplace can be said to have gained ____________. (a) environmental capital (b) competitive advantage (c)...

-

The triple bottom line of organizational performance focuses on the 3 Ps of profit, people, and ____________. (a) principle (b) procedure (c) planet (d) progress

-

The reasons why businesses go international include gaining new markets, finding investment capital, and reducing ____________. (a) political risk (b) protectionism (c) labour costs (d) most favoured...

-

The ____________ is a predominant value system for an organization as a whole. (a) strategy (b) core competency (c) mission (d) corporate culture

-

In order to help implement its corporate strategy, a business firm would likely develop a__________ plan for the marketing department. (a) functional (b) single-use (c) production (d) zero-based

-

Three mutually exclusive design alternatives are being considered. The estimated sales and cost data for each alternative are given on p. 292. The MARR is 20% per year. Annual revenues are based on...

-

Find i 0 (t) for t > 0 in the circuit in Fig. 16.72 . 2 + Vo 1 7.5e-2t u(t) V ( +) 4.5[1 u(t)]V 0.5v. 1H

-

Burbank Corporation (calendar-year end) acquired the following property this year: Burbank acquired the copier in a nontaxable transaction when the shareholder contributed the copier to the business...

-

Olympia Corporation, of Kittery, Maine, wants to exchange its manufacturing facility for Bangor Companys warehouse. Both parties agree that that Olympias building is worth $100,000 and that Bangors...

-

Fizbo Corporation is in the business of breeding and racing horses. Fizbo has taxable income of $5,000,000 other than from these transactions. It has nonrecaptured 1231 losses of $10,000 from 2014...

-

A thin walled loop with a mass of 1.50 kg and with a radius of 10.0 cm rolls down a ramp with a height h=30.0 cm. If the loop starts from rest at the top of the ramp, what will its speed be when it...

-

Suppose there is a uniformly charged, infinitely tall metal surface. The surface charge density is -4.0 x 10^-10 C/m2. An electron is 1.5 meters away from the wall and is launched directly at it with...

-

1. A basketball rolls down a ramp from rest with an acceleration of 2.5 m/s due to grav- up the ramp with an initial velocity of ity. At the same time, a tennis ball starts to roll 3.7 m/s and the...

Study smarter with the SolutionInn App