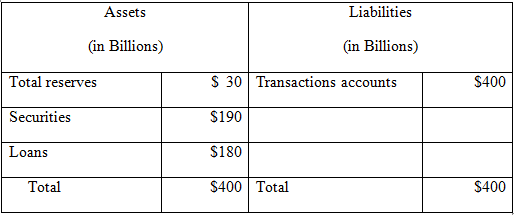

Suppose a banking system with the following balance sheet has no excess reserves. Assume that banks will

Question:

(a) What is the reserve requirement?

(b) Suppose the reserve requirement is changed to 5 percent. Reconstruct the balance sheet of the total banking system after all banks have fully utilized their lending capacity.

(c) By how much has the money supply changed as a result of the lower reserve requirement (step b)?

(d) Suppose the Fed now buys $10 billion of securities directly from the banks. What will the banks€™ books look like after this purchase?

(e) How much excess reserves do the banks have now?

(f) By how much can the money supply now increase?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

The Macro Economy Today

ISBN: 978-1259291821

14th edition

Authors: Bradley R. Schiller, Karen Gebhardt

Question Posted: