Autonomous Control Ltd. (ACL) is a leading automotive parts manufacturer supplying the large original equipment manufacturers (OEMs).

Question:

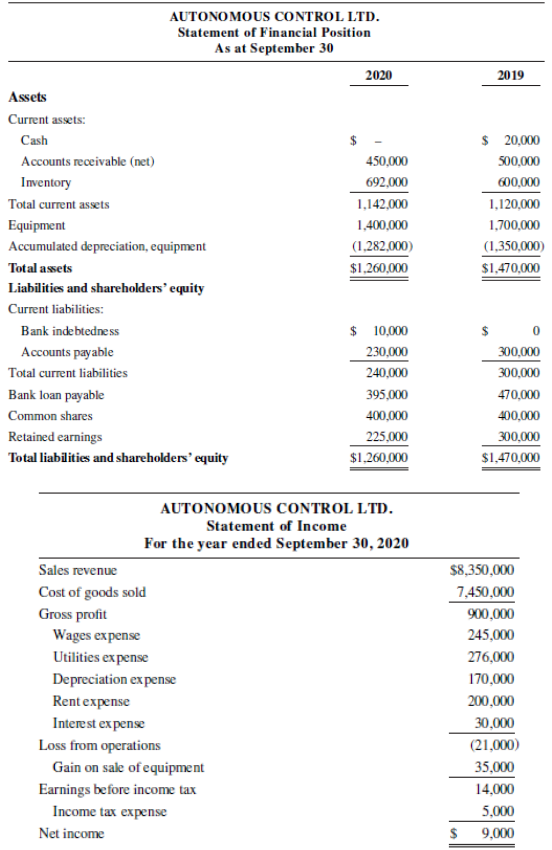

Autonomous Control Ltd. (ACL) is a leading automotive parts manufacturer supplying the large original equipment manufacturers (OEMs). ACL manufactures sensors, electronics, and control technologies that are used by OEMs to make driverless vehicles possible and safe. The London, Ontario-based company has customers across the world, but its largest market is the United States. The company also manufactures traditional auto parts; however, the shift by car manufacturers to more advanced technologies has meant that ACL’s sales declined by 15% over the prior year. The company is hoping that its move into control technologies and the trend to safe driverless vehicles will translate to an increase in sales. In the meantime, the company has been approaching its banks seeking a long-term loan. ACL provided the banks the following financial information:

Additional information:

1. During the year, the company made a principal repayment on the bank loan in the amount of $75,000.

2. Equipment with a net carrying amount of $62,000 was sold during the year.

3. No equipment was purchased during the year.

Required

a. You work for one of the banks in the lending group and have been tasked with preparing the statement of cash flows for ACL using either the direct or indirect method for determining cash flows from operating activities. Prepare the statement.

b. Discuss significant observations from the statement of cash flows that your bank would want to consider.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley