CAE Inc. designs, manufactures, and sells simulation equipment; sells services; and develops training solutions for the civil

Question:

CAE Inc. designs, manufactures, and sells simulation equipment; sells services; and develops training solutions for the civil aviation and defence industries. Its revenues come from the sale of simulation products, development and delivery of training solutions, in-service support, and crew sourcing.

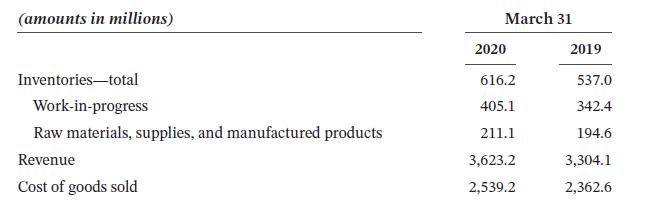

The following selected financial information was taken from CAE’s 2020 annual report. Significant Accounting Policy Note:

Significant Accounting Policy Note:

Raw materials are valued at the lower of average cost and net realizable value. Spare parts to be used in the normal cost of business are valued at the lower of cost, determined on a specific identification basis, and net realizable value. Work-in-progress is stated at the lower of cost, determined on a specific identification basis, and net realizable value. The cost of work in progress includes materials, labour, and an allocation of manufacturing overhead, which is based on normal operating capacity.

Required

Using the above information, do the following:

a. Calculate the inventory turnover ratios for CAE Inc. for 2020 and 2019. Comment on any changes. Use the 2020 and 2019 inventory rather than the average inventory to calculate the ratios.

b. Calculate the gross margin ratio for 2020 and 2019. Comment on any changes.

c. CAE’s statement of income reports revenue as one amount even though its operations include manufacturing and the delivery of services. How might this reporting format affect the analysis of the gross margin ratio?

d. CAE uses the specific identification cost formula for spare parts and work-in-progress. Explain how and why specific identification is an appropriate cost formula for CAE.

e. CAE uses average cost to value its raw materials inventories. Why would the specific identification basis not be appropriate for this classification of inventory?

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119715474

3rd Canadian Edition

Authors: Christopher D. Burnley