Clean Sweep Ltd. manufactures several different brands of vacuum cleaners, from hand-held models to built-in central vacuums.

Question:

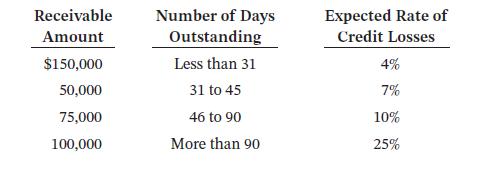

Clean Sweep Ltd. manufactures several different brands of vacuum cleaners, from hand-held models to built-in central vacuums. It sells its products to distributors across Canada on credit, giving customers 30 days to pay. During the year ending June 30, 2024, Clean Sweep recorded sales of $1,550,000. Clean Sweep has determined that the length of time a receivable is outstanding is the most appropriate credit risk characteristic for determining expected credit losses. At June 30, the company prepared the following aging schedule:

The Allowance for Expected Credit Losses had a credit balance of $19,000 before the year-end adjustment was made.

Required

a. Prepare the adjusting entry to bring Allowance for Expected Credit Losses to the desired level.

b. Clean Sweep’s sales manager thinks the company would increase sales if it extended its normal collection cycle to 60 days from its current 30 days. Should the president accept or reject this recommendation? Why? What factors should be considered in making this decision?

c. What suggestions would you make regarding Clean Sweep’s management of its accounts receivable?

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119715474

3rd Canadian Edition

Authors: Christopher D. Burnley