High Liner Foods Incorporated, which is headquartered in Lunenburg, Nova Scotia, operates in the North American packaged

Question:

High Liner Foods Incorporated, which is headquartered in Lunenburg, Nova Scotia, operates in the North American packaged foods industry. The company’s brands include High Liner, Fisher Boy, FPI, Sea Cuisine, Mirabel, and Royal Sea. The company also manufactures products for private labels. The information in Exhibits 7.26A to 7.26D was taken from the company’s 2016 annual report.

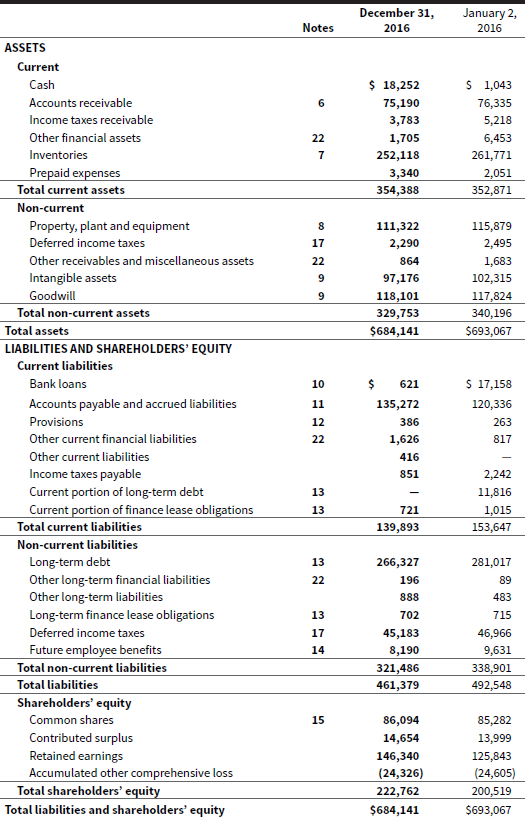

EXHIBIT 7.26A High Liner Foods Incorporated’s 2016 Consolidated Statement of Financial Position

HIGH LINER FOODS INCORPORATED

Consolidated Statement of Financial Position

(in thousands of United States dollars)

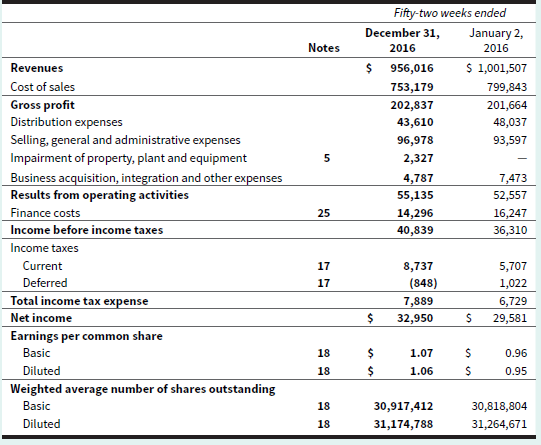

EXHIBIT 7.26B High Liner Foods Incorporated’s 2016 Consolidated Statement of Income

HIGH LINER FOODS INCORPORATED

Consolidated Statement of Income

(in thousands of United States dollars, except per share amounts)

EXHIBIT 7.26C Excerpt from Notes to High Liner Foods Incorporated’s 2016 Financial Statements

HIGH LINER FOODS INCORPORATED

Excerpt from to Financial Statements

(f) Inventories

Inventories are measured at the lower of cost and net realizable value. The cost of manufactured inventories is based on the first-in first-out method. The cost of procured finished goods and unprocessed raw material inventory is based on weighted average cost. Net realizable value is the estimated selling price in the ordinary course of business, less the estimated costs of completion and selling expenses. The cost of inventories includes expenditures incurred in acquiring the inventories, production or conversion costs, and other costs incurred in bringing the inventories to their existing location and condition. In the case of manufactured inventories and semi-finished materials, cost includes an appropriate share of production overheads based on normal operating capacity. Cost may also include transfers from OCI of any gain or loss on qualifying cash flow hedges of foreign currency related to purchases of inventories.

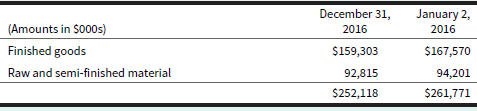

EXHIBIT 7.26D Excerpt from Notes to High Liner Foods Incorporated’s 2016 Financial Statements

HIGH LINER FOODS INCORPORATED

Excerpt from to Financial Statements

Note 7. Inventories

Total inventories at the lower of cost and net realizable value on the statement of financial position comprise the following:

During 2016, $753.2 million (2015: $799.8 million) was recognized as an expense for inventories in cost of sales on the consolidated statement of income. Of this, $4.4 million (2015: $4.9 million) was written-down during the year and included a reversal for unused impairment reserves of $0.5 million (2015: $0.8 million). As of December 31, 2016, the value of inventory subject to a reserve was $11.1 million (January 2, 2016: $13.9 million). As of December 31, 2016, the value of inventory pledged as collateral for the Company’s working capital facility (see Note 10) was $117.4 million (January 2, 2016: $125.3 million).

Required

a. Note 7 (Exhibit 7.26D) breaks down High Liner’s inventory into two classifications. Which classifications of inventory do you believe should be used in determining the inventory turnover ratio? Why?

b. Describe High Liner’s inventory valuation policies in your own words. Specifically, explain what High Liner includes in inventory cost, what cost formula(s) the company uses, and how it values its inventory on the statement of financial position.

c. Does High Liner use the same cost formula for all of its inventories? If not, explain what methods are used for which inventories and why this might be the case.

d. Calculate the inventory turnover ratio and days to sell inventory ratio for both periods. Use the yearend inventory balances instead of the average inventory amounts.

Inventory Turnover RatioInventory Turnover RatioThe inventory turnover ratio is a ratio of cost of goods sold to its average inventory. It is measured in times with respect to the cost of goods sold in a year normally. Inventory Turnover Ratio FormulaWhere,...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley