Indigo Books & Music Inc. is Canadas largest book, gift, and specialty toy retailer. The company operates

Question:

Indigo Books & Music Inc. is Canada’s largest book, gift, and specialty toy retailer. The company operates more than 200 stores under the Chapters, Indigo, Indigospirit, Coles, SmithBooks, and The Book Company banners. The company also has a 50% interest in the Calendar Club of Canada Limited Partnership, which operates mall-based stores and seasonal kiosks. The financial information in Exhibits 7.25A to 7.25D is from the company’s 2017 annual report.

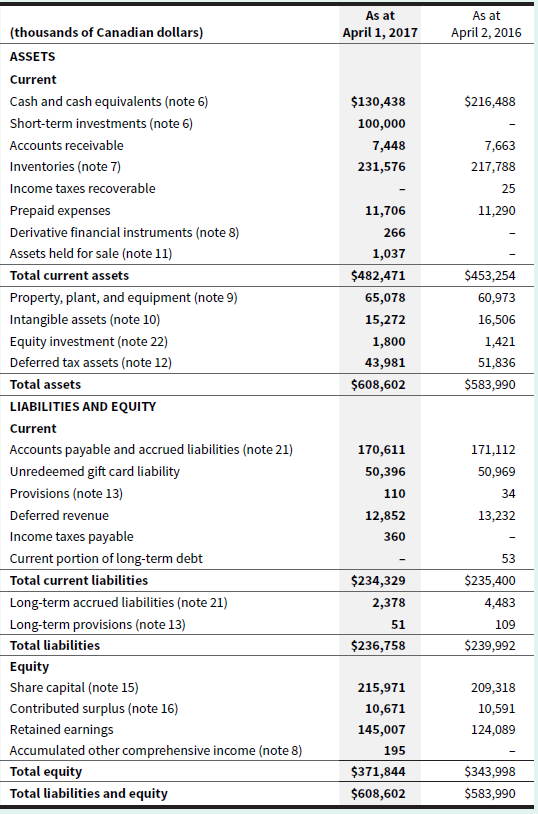

EXHIBIT 7.25A Indigo Books & Music Inc.’s 2017 Consolidated Balance Sheets

INDIGO BOOKS & MUSIC INC.

Consolidated Balance Sheets

EXHIBIT 7.25B Excerpt from Notes to Indigo Books & Music Inc.’s 2017 Financial Statements

INDIGO BOOKS & MUSIC INC.

Excerpt from Notes to Financial Statements

Inventories

The future realization of the carrying amount of inventory is affected by future sales demand, inventory levels, and product quality. At each balance sheet date, the Company reviews its on-hand inventory and uses historical trends and current inventory mix to determine a reserve for the impact of future markdowns that will take the net realizable value of inventory on-hand below cost. Inventory valuation also incorporates a write-down to reflect future losses on the disposition of obsolete merchandise. The Company reduces inventory for estimated shrinkage that has occurred between physical inventory counts and each reporting date based on historical experience as a percentage of sales. In addition, the Company records a vendor settlement accrual to cover any disputes between the Company and its vendors. The Company estimates this reserve based on historical experience of settlements with its vendors.

EXHIBIT 7.25C Excerpt from Notes to Indigo Books & Music Inc.’s 2017 Financial Statements

INDIGO BOOKS & MUSIC INC.

Excerpt from Notes to Financial Statements

Inventories

Inventories are valued at the lower of cost, determined on a moving average cost basis, and market, being net realizable value. Costs include all direct and reasonable expenditures that are incurred in bringing inventories to their present location and condition. Net realizable value is the estimated selling price in the ordinary course of business. When the Company permanently reduces the retail price of an item and the markdown incurred brings the retail price below the cost of the item, there is a corresponding reduction in inventory recognized in the period. Vendor rebates are recorded as a reduction in the price of the products and corresponding inventories are recorded net of vendor rebates.

EXHIBIT 7.25D Excerpt from Notes to Indigo Books & Music Inc.’s 2017 Financial Statements

INDIGO BOOKS & MUSIC INC.

Excerpt from Notes to Financial Statements

7. Inventories

The cost of inventories recognized as an expense was $571.9 million in fiscal 2017 (2016 – $561.5 million). Inventories consist of the landed cost of goods sold and exclude online shipping costs, inventory shrink and damage reserve, and all vendor support programs. The amount of inventory write-downs as a result of net realizable value lower than cost was $9.0 million in fiscal 2017 (2016 – $10.1 million), and there were no reversals of inventory write-downs that were recognized in fiscal 2017 (2016 – nil). The amount of inventory with net realizable value equal to cost was $2.8 million as at April 1, 2017 (April 2, 2016 – $1.5 million).

Required

a. Calculate Indigo’s inventory turnover ratio and the days to sell inventory ratio for 2017 and 2016. Comment on the results.

b. Given the result of your analysis in part “a,” would you expect Indigo to have significant payables to the publishing and distribution companies it purchases its inventory from? Was this the case?

c. Explain Indigo’s inventory valuation polices in your own words. Specifically, explain what Indigo includes in inventory cost, what cost formula(s) the company uses, and how it values its inventory on the statement of financial position.

Inventory Turnover RatioInventory Turnover RatioThe inventory turnover ratio is a ratio of cost of goods sold to its average inventory. It is measured in times with respect to the cost of goods sold in a year normally. Inventory Turnover Ratio FormulaWhere,... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Distribution

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley