Moksh Ltd. started business on January 1, 2024. The following transactions occurred in 2024: 1. On January

Question:

Moksh Ltd. started business on January 1, 2024. The following transactions occurred in 2024:

1. On January 1, the company received $700,000 when it issued 10,000 common shares.

2. On January 1, the company borrowed $250,000 from the bank at 6% annual interest. The loan principal is due in three years.

3. On January 3, the company purchased land and a building for a total of $700,000 cash. The land was recently appraised at a fair market value of $400,000.

4. Inventory costing $190,000 was purchased, of which $100,000 was on account.

5. Sales to customers totalled $310,000. Half of these sales were on account, and the balance were cash sales.

6. The cost of the inventory that was sold to customers in transaction 5 was $128,000.

7. Collections from customers on account totalled $132,000.

8. Payments to suppliers on account totalled $95,000.

9. During the year, employees earned wages of $96,000, of which $4,200 was unpaid at year end.

10. The interest on the bank loan was recognized and paid for the year.

11. The building was estimated to have a useful life of eight years and a residual value of $20,000. The company uses the straight-line method of depreciation.

12. The company declared dividends of $15,000 during the year, of which half were to be paid in January 2025.

Required

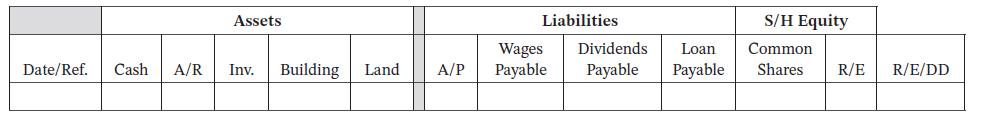

a. Analyze the effects of each transaction on the basic accounting equation, using a template like the one below: b. Prepare a statement of income, a statement of changes in equity, a statement of financial position (unclassified), and a statement of cash flows for 2024.

b. Prepare a statement of income, a statement of changes in equity, a statement of financial position (unclassified), and a statement of cash flows for 2024.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119715474

3rd Canadian Edition

Authors: Christopher D. Burnley