On December 31, 2020, Information Inc. completed its third year of operations. Abdul Mukhtar is a student

Question:

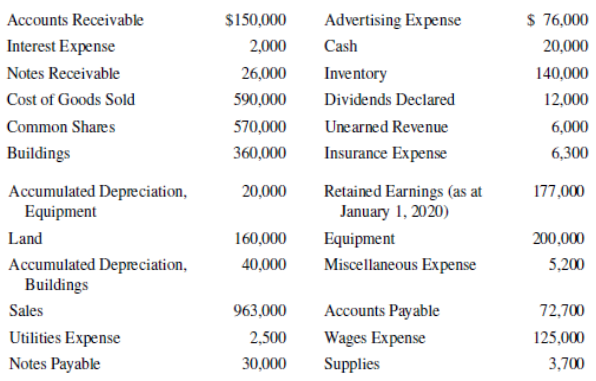

On December 31, 2020, Information Inc. completed its third year of operations. Abdul Mukhtar is a student working part-time in the company’s business office while taking his first accounting course. Abdul assembled the following list of account balances, which are not arranged in any particular order:

These account amounts are correct, but Abdul did not consider the following information:

1. The amount shown as insurance expense includes $900 for coverage during the first two months of 2021.

2. The note receivable is a six-month note that has been outstanding for four months. The interest rate is 10% per year. The interest will be received by the company when the note becomes due at the end of February 2021.

3. As at December 31, 2020, the supplies still on hand had a cost of $600.

4. On November 1, 2020, the company rented surplus space in one of its building to a tenant for $1,000 per month. The tenant paid for six months in advance.

5. Depreciation for 2020 is $10,000 on the buildings and $20,000 on the equipment.

6. Employees earned $3,000 of wages in December 2020 that will not be paid until the first scheduled payday in 2021.

7. Additional dividends of $50,000 were declared in December 2020, but will not be paid until January 2021.

Required

a. Determine the amounts that would appear in an adjusted trial balance for Information Inc. as at December 31, 2020.

b. Prepare a statement of income for the year ended December 31, 2020.

c. Calculate the amount of retained earnings as at December 31, 2020.

d. Prepare a classified statement of financial position as at December 31, 2020.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley