On May 1, 2020, Christina Fashions borrowed $100,000 at a bank by signing a four-year, 6% loan.

Question:

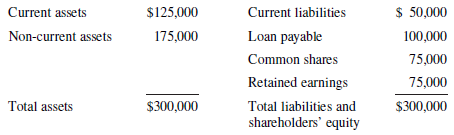

On May 1, 2020, Christina Fashions borrowed $100,000 at a bank by signing a four-year, 6% loan. The terms of the loan require equal principal payments of $25,000 and accrued interest at 6% due annually on April 30. The loan agreement requires the company to maintain a minimum current ratio of 2.0. The December 31, 2020, year-end statement of fi nancial position, immediately prior to the reclassifi cation of long-term debt, follows:

Required

a. Does Christina Fashions comply with the bank’s current ratio requirement prior to recording the accrued interest and reclassifi cation of the current portion of the long-term loan?

b. Prepare journal entries to record the interest payable on December 31, 2020.

c. Prepare the journal entries to reclassify the portion of the long-term loan as current.

d. Does Christina Fashions breach the bank’s current ratio requirement after preparing the journal entries above?

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley