Open Text Corporation provides a suite of business information software products. Exhibit 10.10 contains Note 10 from

Question:

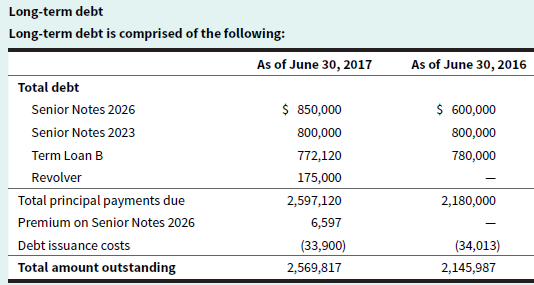

Open Text Corporation provides a suite of business information software products. Exhibit 10.10 contains Note 10 from the company’s 2016 annual report detailing long-term debt. Amounts are in thousands of U.S. dollars.

EXHIBIT 10.10 Excerpt from Open Text Corporation’s 2016 Annual Report

Senior Notes 2026

On May 31, 2016, we issued $600 million in aggregate principal amount of 5.875% Senior Notes due 2026 (Senior Notes 2026) in an unregistered off ering to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (Securities Act), and to certain persons in off shore transactions pursuant to Regulation S under the Securities Act. Senior Notes 2026 bear interest at a rate of 5.875% per annum, payable semi-annually in arrears on June 1 and December 1, commencing on December 1, 2016. Senior Notes 2026 will mature on June 1, 2026, unless earlier redeemed, in accordance with their terms, or repurchased.

On December 20, 2016, we issued an additional $250 million in aggregate principal amount by reopening Senior Notes 2026 at an issue price of 102.75%. The additional notes have identical terms, are fungible with and are a part of a single series with the previously issued $600 million aggregate principal amount of Senior Notes 2026. The outstanding aggregate principal amount of Senior Notes 2026, aft er taking into consideration the additional issuance, is $850 million.

For the year ended June 30, 2017, we recorded interest expense of $43.1 million, relating to Senior Notes 2026 (year ended June 30, 2016 and June 30, 2015—$2.9 million, and nil, respectively).

Senior Notes 2023

On January 15, 2015, we issued $800 million in aggregate principal amount of 5.625% Senior Notes due 2023 (Senior Notes 2023 and together with Senior Notes 2026, Senior Notes) in an unregistered off ering to qualified institutional buyers pursuant to Rule 144A under the Securities Act, and to certain persons in off shore transactions pursuant to Regulation S under the Securities Act. Senior Notes 2023 bear interest at a rate of 5.625% per annum, payable semi-annually in arrears on January 15 and July 15, commencing on July 15, 2015. Senior Notes 2023 will mature on January 15, 2023, unless earlier redeemed, in accordance with their terms, or repurchased.

For the year ended June 30, 2017, we recorded interest expense of $45.0 million, relating to Senior Notes 2023 (year ended June 30, 2016 and June 30, 2015—$45.0 million and $20.6 million, respectively).

Term Loan B

We entered into a $800 million term loan facility (Term Loan B) and borrowed the full amount on January 16, 2014. Borrowings under Term Loan B are secured by a first charge over substantially all of our assets on a pari passu basis with the Revolver (defined below). Term Loan B has a seven year term and repayments made under Term Loan B are equal to 0.25% of the principal amount in equal quarterly installments for the life of Term Loan B, with the remainder due at maturity. Originally, borrowings under Term Loan B were subject to a floating rate of interest at a rate per annum equal to 2.5% plus the higher of LIBOR or 0.75%. However, on February 22, 2017, we entered into an amendment of Term Loan B to, among other things, reduce the interest rate margin applicable to the Term Loan B loans that are LIBOR advances from 2.5% to 2.0% and reduced the LIBOR floor from 0.75% to 0.00%. Thus, interest on the current outstanding balance for Term Loan B is equal to 2.0% plus LIBOR. For the year ended June 30, 2017, we recorded interest expense of $24.8 million, relating to Term Loan B (year ended June 30, 2016 and June 30, 2015—$25.9 million and $26.1 million, respectively).

Revolver

On February 1, 2017, we amended our committed revolving credit facility (the Revolver) to increase the total commitments under the Revolver from $300 million to $450 million. Additionally, on May 5, 2017, we amended the Revolver to, among other things, (i) extend the maturity from December 22, 2019 to May 5, 2022, and (ii) reduce the interest rate margins by 50 basis points. Borrowings under the Revolver are secured by a first charge over substantially all of our assets, and on a pari passu basis with Term Loan B. The Revolver has no fixed repayment date prior to the end of the term. Borrowings under the Revolver bear interest per annum at a floating rate of LIBOR plus a fixed margin dependent on our consolidated net leverage ratio ranging from 1.25% to 1.75%. As of June 30, 2017, the outstanding balance on the Revolver bears an interest rate of approximately 2.74%.

During the year ended June 30, 2017, we drew down $225 million from the Revolver, partially to finance the acquisition of ECD Business and for miscellaneous general corporate purposes. During the year ended June 30, 2017, we repaid $50 million. As of June 30, 2017 we have an outstanding balance on the Revolver of $175 million (June 30, 2016—nil). For the year ended June 30, 2017, we recorded interest expense of $2.6 million, relating to amounts drawn on the Revolver (year ended June 30, 2016 and June 30, 2015—nil, respectively).

Required

a. Open Text had a U.S. $450-million revolving credit facility in place at June 30, 2017, which the company referred to as “the Revolver” in the notes to its financial statements. What is a revolving credit facility?

b. What amount of “the Revolver” had been used at June 30, 2017? What is the maximum amount Open Text could access through “the Revolver”?

c. Open Text also had a U.S. $800-million term loan facility in place at June 30, 2017. What was the amount of the principal outstanding?

d. The term loan had a seven-year term, so why did the company present a portion of the term loan as a current liability?

e. The company also had notes payable at June 30, 2017. Did these notes require repayments of principal over their term? When are interest payments required?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley