The consolidated statements of cash flows and related note disclosure for Sirius XM Canada Holdings Inc. are

Question:

The consolidated statements of cash flows and related note disclosure for Sirius XM Canada Holdings Inc. are in Exhibits 5.21A and 5.21B. Sirius broadcasts satellite radio channels to subscribers.

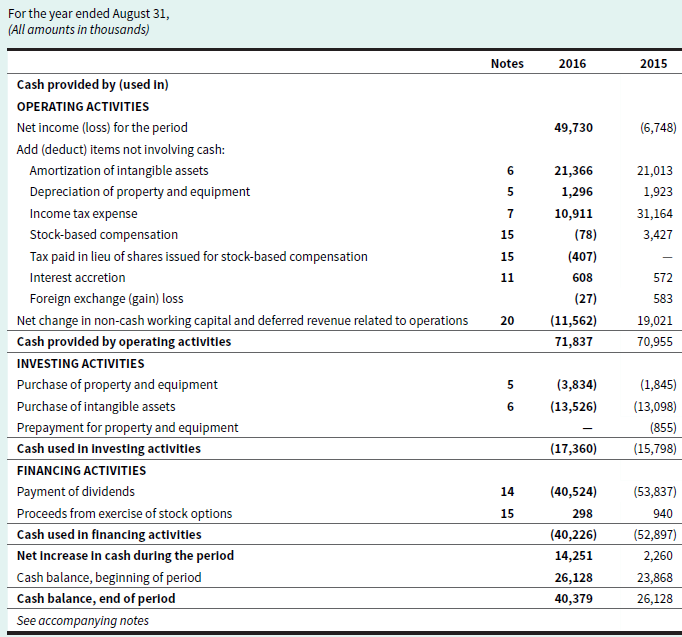

EXHIBIT 5.21A Sirius XM Canada Holdings Inc.’s 2016 Consolidated Statements of Cash Flows

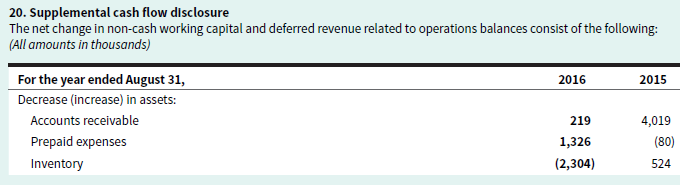

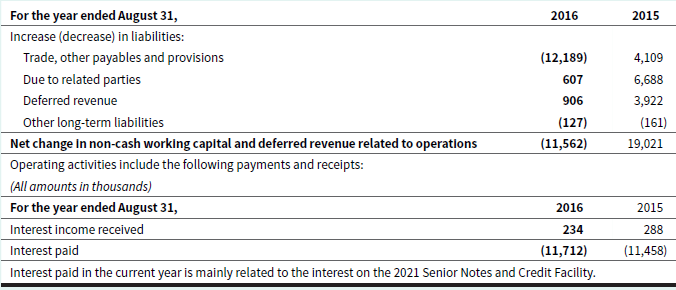

EXHIBIT 5.21B Excerpt from Sirius XM Canada Holdings Inc.’s 2016 Annual Report

Required

a. In total, how much did Sirius’s cash and cash equivalents change during 2013? Was this an increase or a decrease? How did this compare with the previous year?

b. Did Sirius have net income or a net loss in 2016? How did this compare with the cash flows from operating activities? What was the largest difference between these two amounts?

c. What effect did the change in the company’s trade, other payables, and provisions have on cash flows from operating activities in 2016? What does this tell you about the balance owed to these creditors?

d. Did the balance of deferred revenue increase or decrease during 2016? Was this considered to be an inflow or an outflow of cash? What does this tell you about the trend in the amount of the customers’ prepaid subscription fees?

e. Calculate Sirius’s net free cash flow for 2016 and 2015. Is the trend positive or negative?

f. Sirius’s total liabilities were $439,977 thousand at August 31, 2016, and $436,543 thousand at August 31, 2015. Determine the company’s cash flows to total liabilities ratio. Comment on the change year over year. Would your perspective on the results of this ratio calculation change if you were advised that approximately 38% of Sirius’s liabilities were related to deferred revenue?

g. How did the dividends paid by Sirius to its shareholders compare with the company’s net income and cash flows from operating activities?

Free Cash FlowFree cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley