Question:

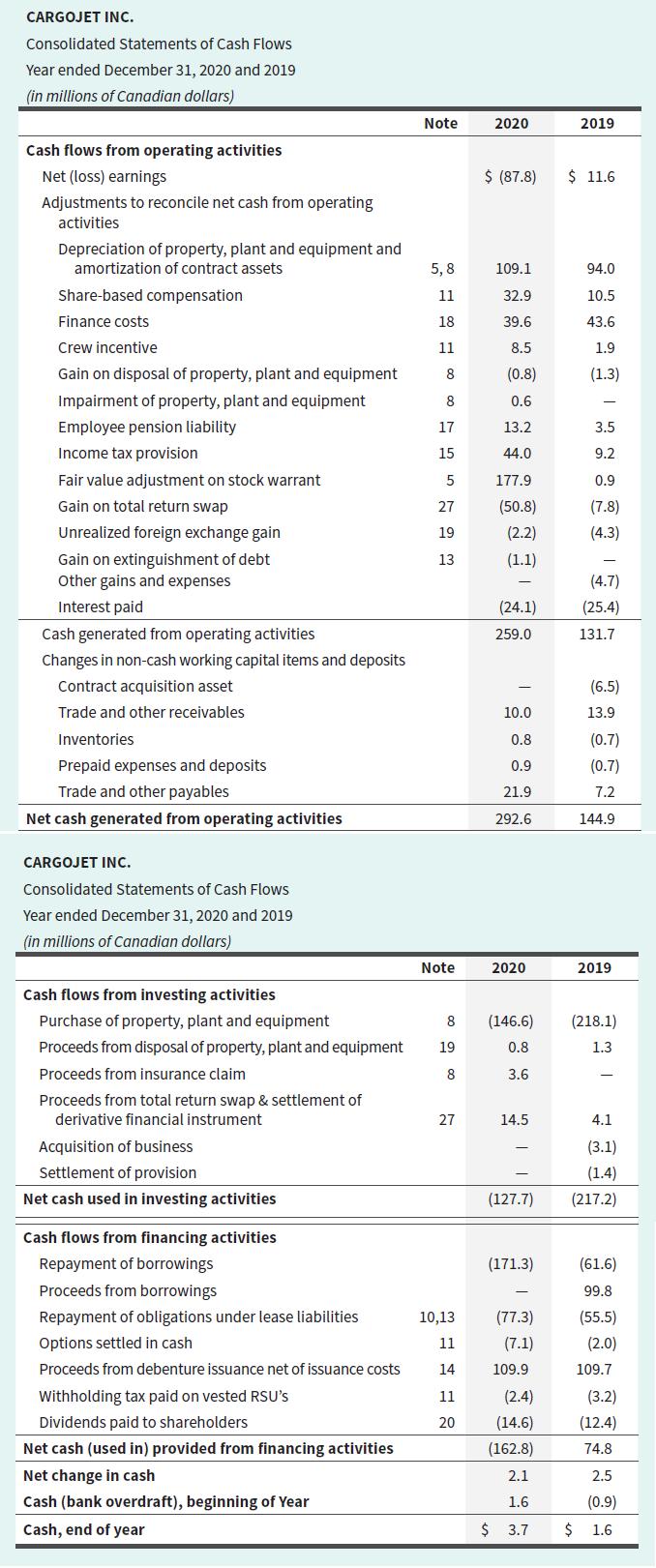

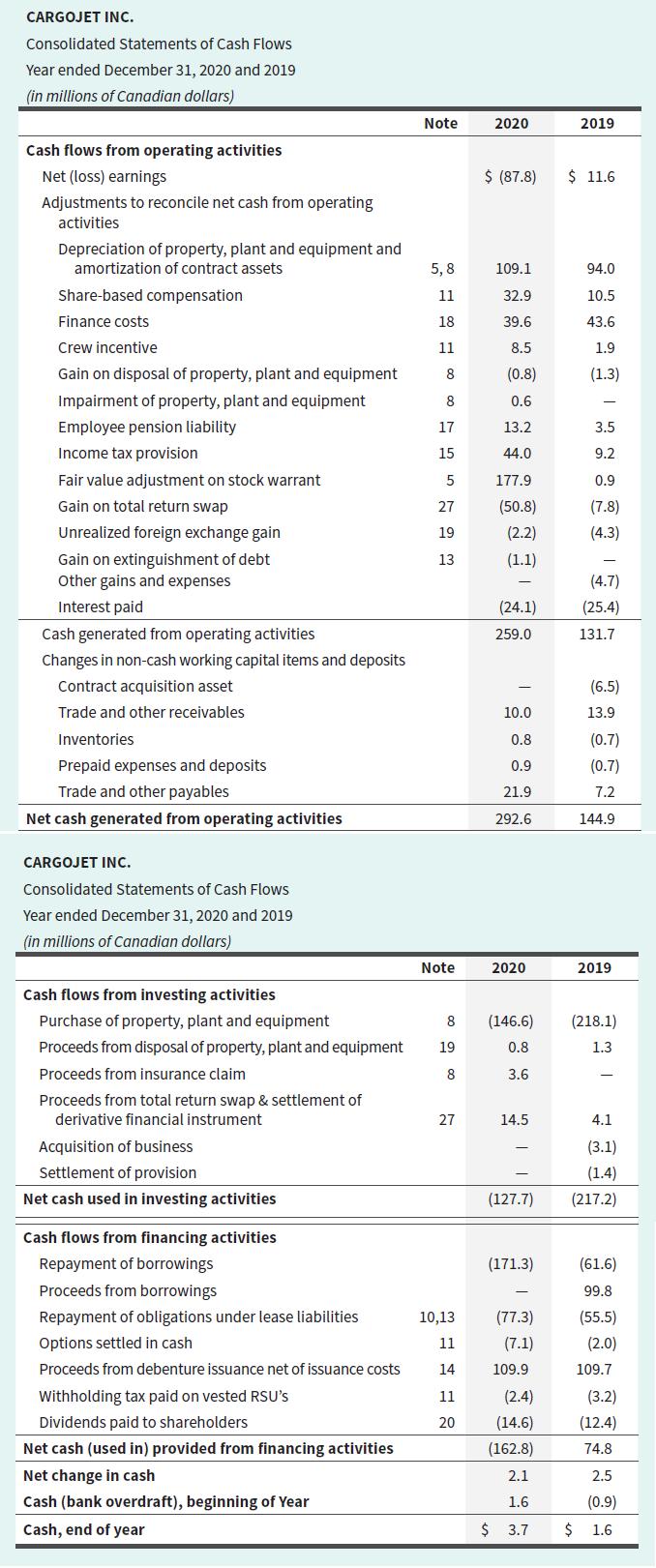

The consolidated statements of cash flows for Cargojet Inc. are in Exhibit 5.24. The company provides domestic air cargo services between 14 major Canadian cities and also operates international routes for cargo customers.

Required

a. In total, how much did Cargojet’s cash change during 2020? Was this an increase or a decrease? How did this compare with the previous year?

b. How did Cargojet’s net income or loss in 2020 compare with the cash flows from operating activities? What was the largest difference between these two amounts?

c. What effect did the change in the company’s trade and other receivables have on cash flows from operating activities in 2020? What does this tell you about the balance owed by the company’s customers?

d. What effect did the change in the company’s trade and other payables have on cash flows from operating activities in 2020? What does this tell you about the balance owed to these creditors? e. Calculate Cargojet’s net free cash flow for 2020 and 2019. Is the trend positive or negative?

f. Cargojet had current liabilities of $180.6 million at the end of 2020 and $114.5 million at the end of 2019. Calculate Cargojet’s operating cash flow ratio for both years. What do these results tell you about the company’s ability to generate sufficient cash to cover its current liabilities?

g. If you were a user of Cargojet’s financial statements—a banker or an investor—how would you interpret the company’s cash flow pattern? How would you assess the risk of a loan to or an investment in Cargojet? Do you think the company is growing rapidly?

Transcribed Image Text:

CARGOJET INC.

Consolidated Statements of Cash Flows

Year ended December 31, 2020 and 2019

(in millions of Canadian dollars)

Cash flows from operating activities

Net (loss) earnings

Adjustments to reconcile net cash from operating

activities

Depreciation of property, plant and equipment and

amortization of contract assets

Share-based compensation

Finance costs

Crew incentive

Gain on disposal of property, plant and equipment

Impairment of property, plant and equipment

Employee pension liability

Income tax provision

Fair value adjustment on stock warrant

Gain on total return swap

Unrealized foreign exchange gain

Gain on extinguishment of debt

Other gains and expenses

Interest paid

Cash generated from operating activities

Changes in non-cash working capital items and deposits

Contract acquisition asset

Trade and other receivables

Inventories

Prepaid expenses and deposits

Trade and other payables

Net cash generated from operating activities

CARGOJET INC.

Consolidated Statements of Cash Flows

Year ended December 31, 2020 and 2019

(in millions of Canadian dollars)

Cash flows from investing activities

Purchase of property, plant and equipment

Proceeds from disposal of property, plant and equipment

Proceeds from insurance claim

Proceeds from total return swap & settlement of

derivative financial instrument

Acquisition of business

Settlement of provision

Net cash used in investing activities

Cash flows from financing activities

Repayment of borrowings

Proceeds from borrowings

Repayment of obligations under lease liabilities

Options settled in cash

Proceeds from debenture issuance net of issuance costs

Withholding tax paid on vested RSU's

Dividends paid to shareholders

Net cash (used in) provided from financing activities

Net change in cash

Cash (bank overdraft), beginning of Year

Cash, end of year

Note

5,8

11

18

11

8

8

17

15

5

27

19

13

Note

8

19

8

27

10,13

11

14

11

20

2020

$ (87.8)

109.1

32.9

39.6

8.5

(0.8)

0.6

13.2

44.0

177.9

(50.8)

(2.2)

(1.1)

(24.1)

259.0

10.0

0.8

0.9

21.9

292.6

2020

14.5

(127.7)

(171.3)

(77.3)

(7.1)

109.9

2019

(2.4)

(14.6)

(162.8)

2.1

1.6

$ 3.7

$ 11.6

94.0

10.5

43.6

1.9

(1.3)

3.5

9.2

(146.6) (218.1)

0.8

1.3

3.6

0.9

(7.8)

(4.3)

(4.7)

(25.4)

131.7

(6.5)

13.9

(0.7)

(0.7)

7.2

144.9

2019

4.1

(3.1)

(1.4)

(217.2)

(61.6)

99.8

(55.5)

(2.0)

109.7

(3.2)

(12.4)

74.8

2.5

(0.9)

$ 1.6