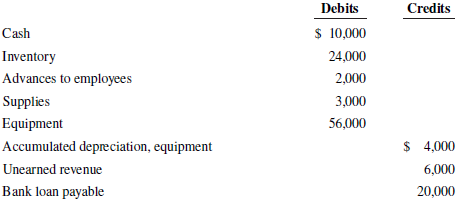

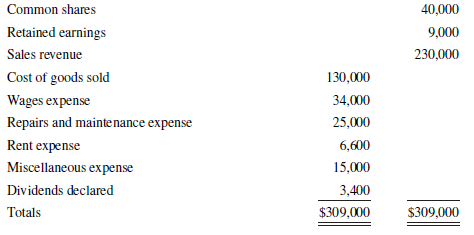

The following trial balance before adjustments is for Snowcrest Ltd. on December 31, 2020: Data for adjusting

Question:

The following trial balance before adjustments is for Snowcrest Ltd. on December 31, 2020:

Data for adjusting entries:

1. As at December 31, 2020, 80% of the wages that had been paid in advance to the salespeople had been earned.

2. A count of the supplies at year end revealed that $600 of supplies were still on hand.

3. Depreciation on the equipment for 2020 was $1,000.

4. The unearned revenue was advance receipts for future deliveries of goods. By December 31, 2020, two-thirds of these deliveries had been made.

5. The bank loan was a six-month loan taken out on October 1, 2020. The interest rate on the loan is 9%, but the interest is not due to be paid until the note is repaid on April 1, 2021.

6. Wages owed at year end and not yet recorded were $500.

7. The rent expense figure includes $600 paid in advance for January 2021.

8. Income tax for the year should be calculated using a tax rate of 25%. After you finish the other adjusting entries, determine the income before income tax and then calculate the tax as 25% of this amount.

Required

Prepare the adjusting entries for the year 2020.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley