Webber Ltd. purchased the net assets of Sitter Inc. in January 2020 for $8,546,000. Appraisals indicated that

Question:

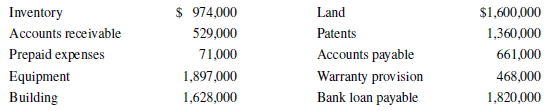

Webber Ltd. purchased the net assets of Sitter Inc. in January 2020 for $8,546,000. Appraisals indicated that the fair values of the assets purchased and liabilities assumed were as follows:

The patent acquired has 10 years remaining in its useful life, but Webber’s management determined that it would contribute to the generation of revenues for 8 years, after which it would be obsolete.

Required

a. Determine the amount of goodwill Webber acquired in the purchase.

b. Prepare the journal entry to record the amortization of the patent for 2020.

GoodwillGoodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley

Question Posted: