You are the manager of a pension fund and one of your staff comes to you to

Question:

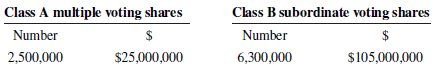

You are the manager of a pension fund and one of your staff comes to you to review a potential investment in the Class B shares of Palm Inc. When you are reviewing the shareholders’ equity of the company you noted the following.

Issued shares:

Class A multiple voting shares—Holders of the multiple voting shares are entitled to 10 votes per multiple voting share.

Class B subordinate voting shares—Holders of the subordinate voting shares are entitled to one vote per subordinate voting share.

Required

Explain why you might be concerned about the presence of the Class A shares. Quantify your concerns where possible.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley

Question Posted: