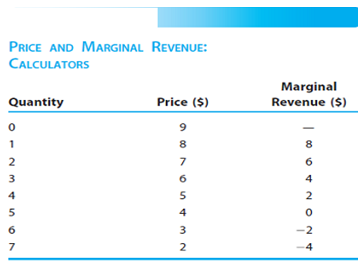

Table illustrates the revenue conditions facing ABC, Inc., and XYZ, Inc., which operate as competitors in the

Question:

Table illustrates the revenue conditions facing ABC, Inc., and XYZ, Inc., which operate as competitors in the U.S. calculator market. Each firm realizes constant long-term costs (MC AC) of $4 per unit. On graph paper, plot the enterprise demand, marginal revenue, and MC AC schedules. On the basis of this information, answer the following questions.

a. With ABC and XYZ behaving as competitors, the equilibrium price is $_____ and output is _____. At the equilibrium price, U.S. households attain $_____ of consumer surplus, while company profits total $_____.

b. Suppose the two organizations jointly form a new one, JV, Inc., whose calculators replace the output sold by the parent companies in the U.S. market. Assuming that JV operates as a monopoly and that its costs (MC=AC) equal $4 per unit, the company’s output would be at a price of $ _____, and total profit would be $_____. Compared to the market equilibrium position achieved by ABC and XYZ as competitors, JV as a monopoly leads to a deadweight loss of consumer surplus equal to $ _____.

c. Assume now that the formation of JV yields technological advances that result in a per-unit cost of only $2; sketch the new MC = AC schedule in the figure. Realizing that JV results in a deadweight loss of consumer surplus, as described in part b, the net effect of the formation of JV on U.S. welfare is a gain/ loss of $ _____. If JV’s cost reduction was due to the wage concessions of JV’s U.S. employees, the net welfare gain/ loss for the United States would equal $ _____. If JV’s cost reductions resulted from changes in work rules leading to higher worker productivity, the net welfare gain/loss for the United States would equal $ _____.

Step by Step Answer: