Tax rates refer to the corporate marginal tax rate information in Table 2.3. a. Why do you

Question:

Tax rates refer to the corporate marginal tax rate information in Table 2.3.

a. Why do you think the marginal tax rate jumps up from 34 percent to 39 percent at a taxable income of $100,001, and then falls back to a 34 percent marginal rate at a taxable income of $335,001?

b. Compute the average tax rate for a corporation with exactly $335,001 in taxable income. Does this confirm your explanation in part (a)? What is the average tax rate for a corporation with exactly $18,333,334? Is the same thing happening here?

c. The 39 percent and 38 percent tax rates both represent what is called a tax ??bubble.?? Suppose the government wanted to lower the upper threshold of the 39 percent marginal tax bracket from $335,000 to $200,000. What would the new 39 percent bubble rate have to be?

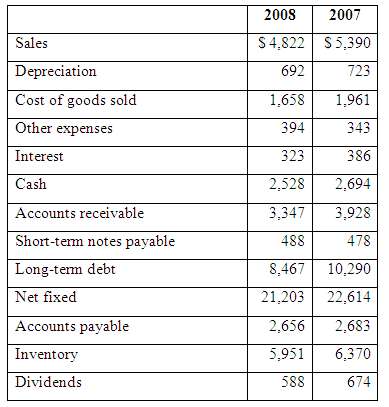

Use the following information for Taco Swell, Inc., for Problems 25 and 26 (assume the tax rate is 34percent).

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Fundamentals of Corporate Finance

ISBN: 978-0077861629

8th Edition

Authors: Stephen A. Ross, Randolph W. Westerfield, Bradford D.Jordan