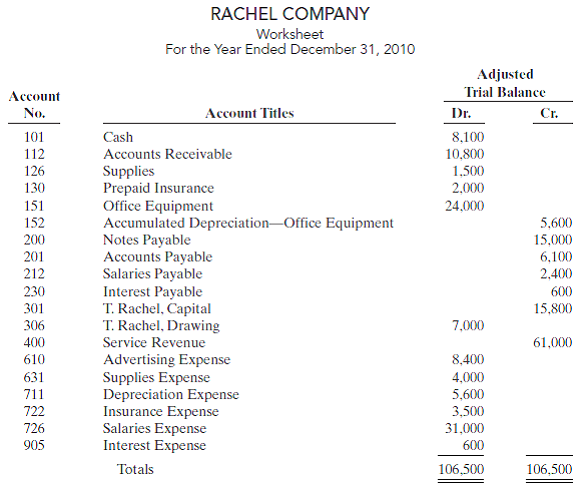

The adjusted trial balance columns of the worksheet for Rachel Company, owned by Toni Rachel, are as

Question:

The adjusted trial balance columns of the worksheet for Rachel Company, owned by Toni Rachel, are as follows.

Instructions

(a) Complete the worksheet by extending the balances to the financial statement columns.

(b) Prepare an income statement, owner’s equity statement, and a classified balance sheet. (Note: $9,000 of the notes payable become due in 2011.) Toni Rachel did not make any additional investments in the business during the year.

(c) Prepare the closing entries. Use J14 for the journal page.

(d) Post the closing entries. Use the three-column form of account. Income Summary is No. 350.

(e) Prepare a post-closing trial balance.

RACHEL COMPANY Worksheet For the Year Ended December 31, 2010 Adjusted Trial Balance Account Cr. No. Dr. Account Titles 101 Cash 8,100 112 Accounts Receivable 10,800 1,500 126 Supplies Prepaid Insurance Office Equipment Accumulated Depreciation-Office Equipment Notes Payable Accounts Payable Salaries Payable Interest Payable T. Rachel, Capital T. Rachel, Drawing 130 2,000 151 24,000 152 5,600 200 15,000 201 6,100 212 2,400 230 600 301 15,800 306 7,000 400 Service Revenue 61,000 610 Advertising Expense Supplies Expense Depreciation Expense Insurance Expense Salaries Expense Interest Expense 8,400 4,000 5,600 631 711 722 3,500 726 31,000 905 600 106,500 Totals 106,500

Step by Step Answer:

a RACHEL COMPANY Partial Worksheet For the Year Ended December 31 2010 Account Adjusted Trial Balance Income Statement Balance Sheet No Titles Dr Cr Dr Cr Dr Cr 101 Cash 8100 8100 112 Accounts Receiva...View the full answer

Accounting Principles

ISBN: 978-0470533475

9th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Accounting questions

-

The adjusted trial balance columns of the worksheet for Rachel Company Inc. are as follows. Instructions (a) Complete the worksheet by extending the balances to the financial statement columns. (b)...

-

The adjusted trial balance columns of the worksheet for Bleecker Street, Ltd., owned by Raymond Pearson, are as follows. Instructions (a) Complete the worksheet by extending the balances to the...

-

The adjusted trial balance columns of the worksheet for Thao Company, owned by D. Thao, are as follows. Instructions (a) Complete the worksheet by extending the balances to the financial statement...

-

Suppose that a firm is producing in the short run with output given by: Q = 200.5L 2.5L 2 , The firm hires labor at a wage of $25 per hour and sells the good in a competitive market at P = $50 per...

-

Refer to the information for Speedy Pete's on the previous page. Assume that this information was used to construct the following formula for monthly delivery cost. Total Delivery Cost = $41,850 +...

-

Which of the following statements uses the term homologous correctly? A. The two X chromosomes in female mammalian cells are homologous to each other. B. The ct-tubulin gene in Saccharomyces...

-

(a) In Figure 10.2, what is the ball's velocity the instant before it is released? (b) Is the ball's speed in the reference frame of the cart greater than, equal to, or smaller than its speed in the...

-

The ledger of G.K. Reid Company at the end of the current year shows Accounts Receivable $120,000, Sales Revenue $840,000, and Sales Returns and Allowances $30,000 Instructions a) If G.K Reid uses...

-

1. Identify the product which represents the solid state in the above reaction. a) Barium chloride b) Barium sulphate c) Sodium chloride d) Sodium sulphate 2. The colour of the solution observed...

-

Wildcat Sporting Goods (WSG) sells athletic shoes and trendy sports apparel to a variety of sporting goods stores in the Northeast and, in 2011, WSG also began direct Internet sales to consumers....

-

The trial balance columns of the worksheet for Sasse Roofing at March 31, 2010, are as follows. Other data:1. A physical count reveals only $650 of roofing supplies on hand.2. Depreciation for March...

-

The completed financial statement columns of the worksheet for Muddy Company are shown below. Instructions(a) Prepare an income statement, an owner??s equity statement, and a classified balance...

-

Read one of the Mechanical Engineering articles listed in the References section at the end of this chapter, describing a top ten achievement. Prepare a technical report of at least 250 words...

-

2. In 2000, 942.5 million Compact Discs (CDs) were sold. From 2000 through 2012, sales of CDs declined at an average rate of 12.3% per year. a. Complete the model below by filling in the appropriate...

-

How does over-the-counter (OTC) trading differ from trading on an organized exchange?

-

Discuss the one main type of unemployment that is linked to the business cycle. Focusing on the two main tools of fiscal policy, explain how the government can use fiscal policy to dampen an...

-

Over-the-Counter (OTC) Medication Homework Assignment Think Critically (1 pt each) 1. In a chain store or mass merchandiser outlet, where is the pharmacy located? Why? 2. The FDA recently allowed...

-

Discuss the effectiveness of the major OTC weight loss products.?

-

Assume that there is an increase in the demand for money at every interest rate. Using a diagram, show what effect this will have on the equilibrium interest rate for a given money supply.

-

How does the organizational structure of an MNC influence its strategy implementation?

-

What are the major physical components of a hard disk drive?

-

Weber Company purchases $45,000 of raw materials on account, and it incurs $60,000 of factory labor costs. Journalize the two transactions on March 31 assuming the labor costs are not paid until...

-

Data for Weber Company are given in BE3-1. Supporting records show that (a) The Assembly Department used $24,000 of raw materials and $35,000 of the factory labor, and (b) The Finishing Department...

-

Factory labor data for Weber Company are given in BE3-2. Manufacturing overhead is assigned to departments on the basis of 200% of labor costs. Journalize the assignment of overhead to the Assembly...

-

For background pertinent to this problem, review Conceptual Example 6. In Figure 5.7 the man hanging upside down is holding a partner who weighs 671 N. Assume that the partner moves on a circle that...

-

The last four years of returns for a stock are as follows: 1 Year Return - 3.7% 2 27.6% 3 4 12.1% 4.1% a. What is the average annual return? b. What is the variance of the stock's returns? c. What is...

-

(11%) Problem 6: The diagram shows a crate with mass m = 20.7 kg being pushed up an incline that makes an angle o = 29.8 degrees with horizontal. The pushing force is horizontal, with magnitude P =...

Study smarter with the SolutionInn App