The assets and equities of the Quen, Reed, and Stacy partnership at the end of its fiscal

Question:

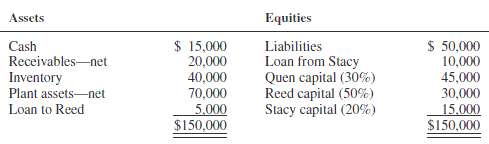

The assets and equities of the Quen, Reed, and Stacy partnership at the end of its fiscal year on October 31, 2011, are as follows:

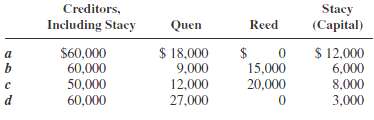

The partners decide to liquidate the partnership. They estimate that the non-cash assets, other than the loan to Reed, can be converted into $100,000 cash over the two-month period ending December 31, 2011. Cash is to be distributed to the appropriate parties as it becomes available during the liquidation process.1. The partner most vulnerable to partnership losses on liquidation is:a. Quenb. Reedc. Reed and Quen equallyd. Stacy2. If $90,000 is available for the first distribution, it should be paid to:

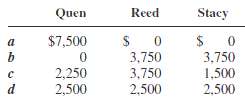

3. If a total amount of $7,500 is available for distribution to partners after all non-partner liabilities are paid, it should be paid asfollows:

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith