The financial structure of a firm refers to the way the firm's assets are divided by equity

Question:

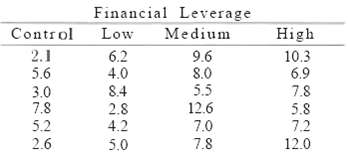

The financial structure of a firm refers to the way the firm's assets are divided by equity and debt, and the financial leverage refers to the percentage of assets financed by debt. In the paper The Effect of Financial Leverage on Return, Tai Ma of the Virginia Polytechnic Institute: and State University claims that financial leverage can be used to increase the rate of return on equity. To say it another way, stockholders can receive higher returns on equity with the same amount, of investment by the use: of financial leverage. The following data show the rates of return on equity using 3 different levels of financial leverage' and a control level (zero debt) for 24 randomly selected firms. Source: Standard & Poor's Machinery Industry Survey, 1975.

(a) Perform the analysis of variance at the 0.05 level of significance.

(b) Use Dunnett's test at the 0.01 level of significance to determine whether the mean rates of return on equity at the low, medium, and high levels of financial leverage are higher than at the controllevel.

Step by Step Answer:

Probability & Statistics For Engineers & Scientists

ISBN: 9780130415295

7th Edition

Authors: Ronald E. Walpole, Raymond H. Myers, Sharon L. Myers, Keying