The following are the Class Companys unit costs of manufacturing and marketing a high-style pen at an

Question:

Manufacturing cost Direct materials ......$1.00

Direct manufacturing labour ......... 1.20

Variable manufacturing overhead cost ..... 0.80

Fixed manufacturing overhead cost ...... 0.50

Marketing cost Variable ......... 1.50

Fixed ................. 0.90

REQUIRED

The following situations refer only to the preceding data; there is no connection between the situations. Unless stated otherwise, assume a regular selling price of $6 per unit. Choose the best answer to each question. Show your calculations.

1. For an inventory of 10,000 units of the high-style pen presented in the balance sheet, the appropriate unit cost to use is

(a) $3.00

(b) $3.50

(c) $5.00

(d) $2.20

(e) $5.90

2. The pen is usually produced and sold at the rate of 240,000 units per year (an average of 20,000 per month). The selling price is $6 per unit, which yields total annual revenue of$1,440,000. Total costs are $1,416,000, and operating income is $24,000, or $0.10 per unit. Market research estimates that unit sales could be increased by 10% if prices were cut to $5.80. Assuming the implied cost behaviour patterns continue, this action, if taken, would:

a. Decrease operating income by $7,200.

b. Decrease operating income by $0.20 per unit ($48,000) but increase operating income by 10% of revenue ($144,000), for a net increase of $96,000.

c. Decrease fixed cost per unit by 10%, or $0.14, per unit, and thus decrease operating income by $0.06 ($0.20 €“ $0.14) per unit.

d. Increase unit sales to 264,000 units, which at the $5.80 price would give total revenue of $1,531,200 and lead to costs of $5.90 per unit for 264,000 units, which would equal$1,557,600, and result in an operating loss of $26,400.

e. None of these.

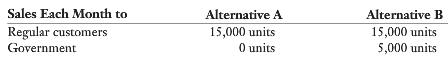

3. A contract with the government for 5,000 units of the pens calls for the reimbursement of all manufacturing costs plus a fixed fee of $1,000. No variable marketing costs are incurred on the government contract. You are asked to compare the following two alternatives:

Operating income under alternative B is greater than that under alternative A by

(a) $1,000

(b) $2,500

(c) $3,500

(d) $300

(e) None of these.

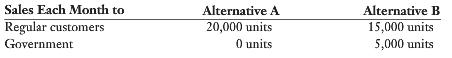

4. Assume the same data with respect to the government contract as in requirement 3 except that the two alternatives to be compared are

Operating income under alternative B relative to that under alternative A is

(a) $4,000 less

(b) $3,000 greater

(c) $6,500 less

(d) $500 greater

(e) None of these.

5. The company wants to enter a foreign market in which price competition is keen. The company seeks a one-time-only special order for 10,000 units on a minimum-unit-price basis. It expects that shipping costs for this order will amount to only $0.75 per unit, but the fixed costs of obtaining the contract will be $4,000. The company incurs no variable marketing costs other than shipping costs. Domestic business will be unaffected. The selling price to break even is

(a) $3.50

(b) $4.15

(c) $4.25

(d) $3.00

(e) $5.00

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0133392883

6th Canadian edition

Authors: Horngren, Srikant Datar, George Foster, Madhav Rajan, Christ