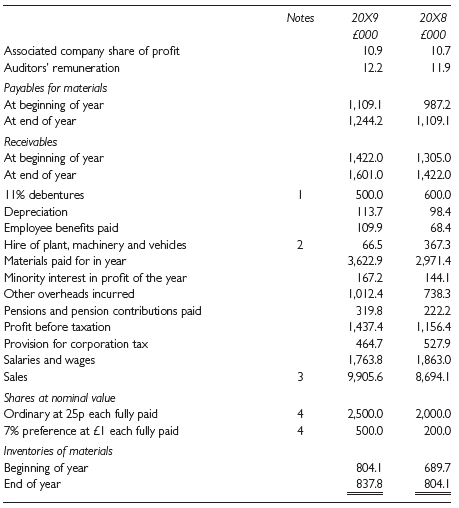

The following information relates to the Plus Factors Group plc for the years to 30 September 20X8

Question:

Ordinary dividends were declared as follows:

Interim 1.12 pence per share (20X8, l.67p)

Final 3.57 pence per share (20X8, 2.61p)

Average number of employees was 196 (20X8, 201)

Notes:

1 £300,000 of debentures were redeemed at par on 31 March 20X9 and £200,000 new debentures at the same rate of interest were issued at £98 for each £100 nominal value on the same date. The new debentures are due to be redeemed in five years€™ time.

2 This is the amount for inclusion in the statement of comprehensive income.

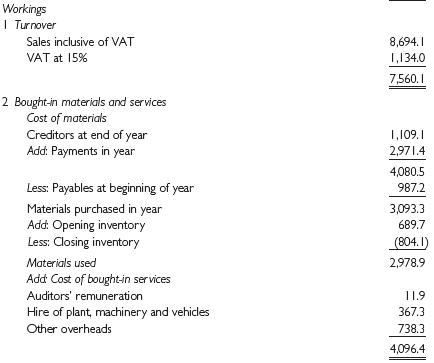

3 All the groups€™ sales are subject to value added tax at 15% and the figures given include such tax. All other figures are exclusive of value added tax. This VAT rate has been increased to 17.5% and may be subject to future changes, but for the purposes of this question the theory and workings remain the same irrespective of the rate.

4 All shares have been in issue throughout the year.

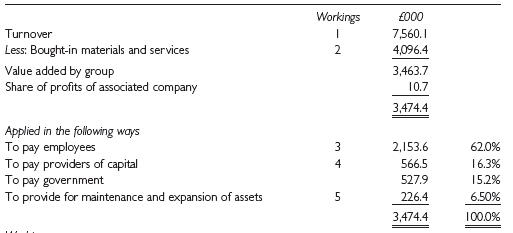

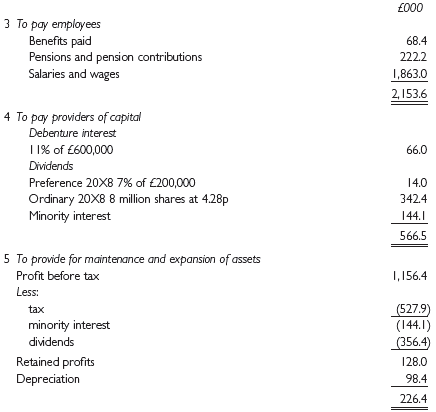

The statement of value added is available for 20X8 and the 20X9 statement needs to be completed.

Working

Required:

(a) Prepare a statement of value added for the year to 30 September 20X9. Include a percentage breakdown of the distribution of value added.

(b) Produce ratios related to employees€™ interests based on the statement in (a) and explain how they might be of use.

(c) Explain briefly what the difficulties are of measuring and reporting financial information in the form of a statement of value added.

DistributionThe word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Financial Accounting and Reporting

ISBN: 978-0273744443

14th Edition

Authors: Barry Elliott, Jamie Elliott