The following information was taken from the records of Gibson Inc. for the year 2012: income tax

Question:

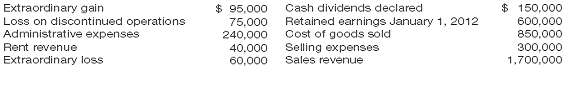

The following information was taken from the records of Gibson Inc. for the year 2012: income tax applicable to income from continuing operations $119,000; income tax applicable to loss on discontinued operations $25,500; income tax applicable to extraordinary gain $32,300; income tax applicable to extraordinary loss $20,400; and unrealized holding gain on available-for-sale securities $15,000.

Shares outstanding during 2012 were 100,000.Instructions(a) Prepare a single-step income statement for 2012.(b) Prepare a retained earnings statement for 2012.(c) Show how comprehensive income is reported using the second income statementformat.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: