The following selected accounts appear in the ledger of Okie Environmental Corporation on August 1, 2010, the

Question:

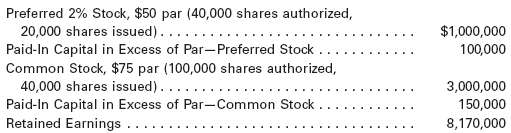

The following selected accounts appear in the ledger of Okie Environmental Corporation on August 1, 2010, the beginning of the current fiscal year:

During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows:(a) Issued 17,500 shares of common stock at $81, receiving cash.(b) Issued 8,000 shares of preferred 2% stock at $63.(c) Purchased 5,000 shares of treasury common for $390,000.(d) Sold 3,000 shares of treasury common for $240,000.(e) Sold 1,000 shares of treasury common for $75,000.(f) Declared cash dividends of $1 per share on preferred stock and $0.80 per share on common stock.(g) Paid the cash dividends.InstructionsJournalize the entries to record the transactions. Identify each entry byletter.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Accounting

ISBN: 978-0324662962

23rd Edition

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren