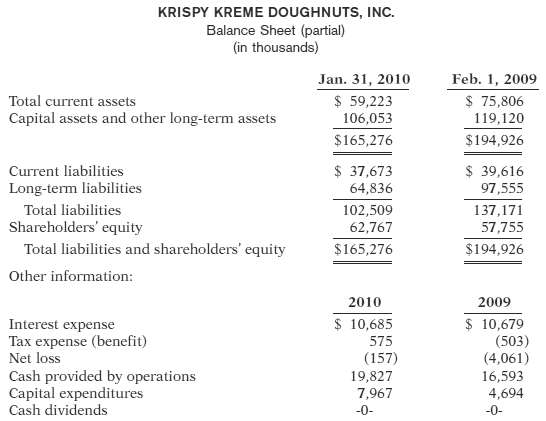

The following selected information was taken from the financial statements of Krispy Kreme Doughnuts, Inc. The Company

Question:

The following selected information was taken from the financial statements of Krispy Kreme Doughnuts, Inc.

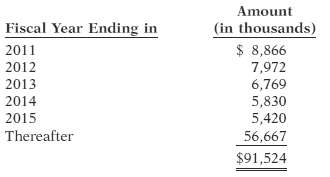

The Company leases equipment and facilities under both capital and operating leases. The approximate future minimum lease payments under non-cancelable (operating) leases as of January 31, 2010, are set forth in the following table:

Rent expense, net of rental income, totaled $9.6 million in fiscal 2010, $11.8 million in fiscal 2009 and $14.8 million in fiscal 2008.Instructions(a) Calculate each of the following ratios for 2010 and 2009.(1) Current ratio.(2) Free cash flow.(3) Debt to total assets ratio.(b) Comment on Krispy Kreme??s liquidity and solvency.(c) Read the company??s note on leases (Note 10). If the operating leases had instead been accounted for like a purchase, assets and liabilities would have increased by approximately $68,000,000. Recalculate the debt to total assets ratio for 2010 and discuss the implications for analysis.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Financial Accounting Tools for business decision making

ISBN: 978-0470534779

6th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso