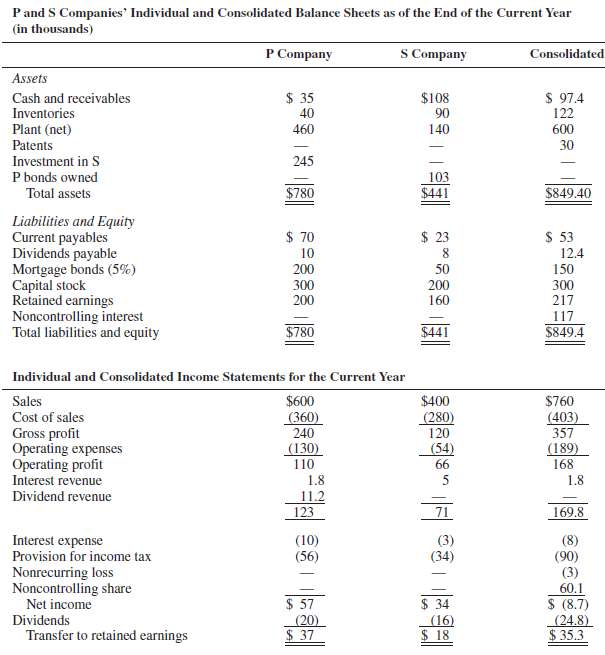

The individual and consolidated balance sheets and income statements of P and S Companies for the current

Question:

The individual and consolidated balance sheets and income statements of P and S Companies for the current year are presented in the accompanying table. The entity theory is used.

ADDITIONAL INFORMATION

1. P Company purchased its interest in S Company several years ago.

2. P Company sells products to S Company for further processing and also sells to firms outside the affiliated entity. The inventories of S Company include an intercompany profit at both the beginning and the end of the year.

3. At the beginning of the current year, S Company purchased bonds of P Company having a maturity value of $100,000. These bonds are being held as available-for-sale securities and are, correspondingly, carried at fair value. No change in fair value has occurred over the course of the year. S Company has agreed to offer P Company the option of reacquiring the bonds at S's cost before deciding to dispose of them on the open market.

REQUIRED: Answer the following questions on the basis of the preceding information.

1. Does P Company carry its investment in S Company on the cost or the equity basis? Explain the basis of your answer.

2. If S Company's common stock has a stated value of $100 per share, how many shares does P Company own? How did you determine this?

3. When P acquired its interest in S Company, the assets and liabilities of S Company were recorded at their fair values. The $30,000 patents represents unamortized patents at the end of the current year. The unrecorded patents were $50,000 under entity theory, and the amortization is over a 10-year period. What was the amount of S's retained earnings at the date that P Company acquired its interest in S Company?

4. What is the nature of the nonrecurring loss appearing on the consolidated income statement? Reproduce the consolidating entry from which this figure originated and explain.

5. What is the amount of intercompany sales during the current year by P Company to S Company?

6. Are there any intercompany debts other than the intercompany bondholdings? Identify any such debts, and state which company is the debtor and which is the creditor in each case. Explain your reasoning.

7. What is the explanation for the difference between the consolidated cost of goods sold and the combined cost of goods sold of the two affiliated companies? Prepare a schedule reconciling combined and consolidated cost of goods sold, showing the amount of intercompany profit in the beginning and ending inventories of S Company and demonstrating how you determined the amount of intercompany profit.

8. Show how the $8,700 noncontrolling interest share in total consolidated net income was determined.

9. Show how the total noncontrolling interest on the balance sheet ($117,000) was determined.

10. Beginning with the $200,000 balance in P Company's retained earnings at the end of the current year, prepare a schedule in which you derive the $217,000 balance of consolidated retained earnings at the end of the currentyear.

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith