The postclosing trial balance of the general fund of Serene Hospital, a not-for-profit entity, on December 31,

Question:

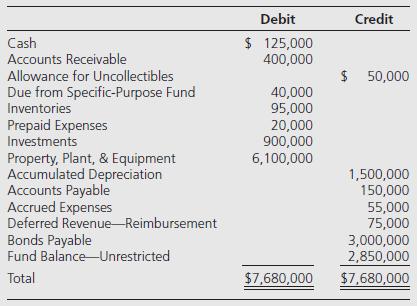

The postclosing trial balance of the general fund of Serene Hospital, a not-for-profit entity, on December 31, 20X1, was as follows:

During 20X2 the following transactions occurred:

1. Provided the value of patient services, $6,160,000.

2. Approved contractual adjustments of $330,000 from patients’ bills.

3. Had operating expenses totaling $5,600,000 as follows:

Nursing services ……………… $1,800,000

Other professional services …… 1,200,000

Fiscal services ………………….. 250,000

General services ………………. 1,550,000

Bad debts ……………………….. 120,000

Administration ………………….. 280,000

Depreciation ……………………. 400,000

Accounts credited for operating expenses other than depreciation:

Cash ………………………….. $4,580,000

Allowance for Uncollectibles …… 120,000

Accounts Payable ……………….. 170,000

Accrued Expenses ………………… 35,000

Inventories ……………………….. 195,000

Prepaid Expenses …………………. 30,000

Donated Services …………………. 70,000

4. Received $75,000 cash from specific-purpose fund for partial reimbursement of $100,000 for operating expenditures made in accordance with a restricted gift. The receivable increased by the remaining $25,000 to an ending balance of $65,000.

5. Had payments for inventories and prepaid expenses of $176,000 and $24,000, respectively.

6. Received $85,000 income from endowment fund investments.

7. Sold an X-ray machine that had cost $30,000 and had accumulated depreciation of $20,000 for $17,000.

8. Collected $5,800,000 in receivables and wrote off $132,000.

9. Acquired investments amounting to $60,000.

10. Had $72,000 income from board-designated investments.

11. Paid the beginning balance in Accounts Payable and Accrued Expenses.

12. Had a $20,000 increase in Deferred Revenue—Reimbursement.

13. Received $140,000 from the plant replacement and expansion fund for acquiring fixed assets.

14. Had $63,000 in net receipts from the cafeteria and gift shop.

Required

a. Prepare journal entries to record the transactions for the general fund. Omit explanations.

b. Prepare comparative balance sheets for only the general fund for 20X2 and 20X1.

c. Prepare a statement of operations for the unrestricted general fund for 20X2.

d. Prepare a statement of cash flows for 20X2.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0078025624

10th edition

Authors: Theodore E. Christensen, David M. Cottrell, Richard E. Baker