The process of bond valuation is based on the fundamental concept that the current price of a

Question:

The process of bond valuation is based on the fundamental concept that the current price of a security can be determined by calculating the present value of the cash flows that the security will generate in the future.

There is a consistent and predictable relationship between a bond's coupon rate, its par value, a bondholders required rectum, and the bond's resulting Intrinsic value. Trading at a discount, trading at a premium, and trading at par refer to particular relationships between a bond's intrinsic value and its par value. These result from the relationship between a bond's coupon rate and a bondholder’s required rate of return.

Remember, a bond's coupon rate partially determines the interest based faun that a bond________ pay, and a bondholder's required return reflects the return that a bondholder_________ to receive from a pen Investment.

The mathematics of bond valuation imply a indictable relationship between the bond's coupon rate, the bondholders required return, the bond's par value, and its intrinsic value. These relationships can be summarized as blows:

• When the bond's coupon rate is equal to the bondholders required return, the bond's intrinsic value will equal its par value, and the bond von trade at par.

• When the bond's coupon rate is greater to the bondholders required return, the bond's intrinsic value will its pm value, and the bond will trade at a premium. • when the bond's coupon rate is less than the bondholders required return, the bond's intrinsic value will be less than its par value, and the bond will trade at

IC! example, assume Olivia wants to earn a reborn of 5.00% and is offered the opportunity to purchase a $1,000 par value bond that pays a 5.00% coupon rate (distributed semiannually) wet three years remaining to maturity. The following formula can be used to compute the bond's intrinsic value:

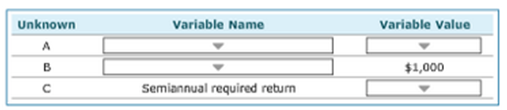

Complete the following table by identifying the appropriate corresponding variables used in the equation.

Complete the following table by identifying the appropriate corresponding variables used in the equation.

Based on this equation and the data, it is _______ to expect that Olivia’s potential bond investment is currently exhibiting an intrinsic value equal to $1,000.

Now, consider the situation in which Olivia wants to earn a return a 3.00%, but the bond being considered for purchase offers a coupon rate of 5.00%%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If you round the bond's intrinsic value to the nearest whole dollar, then its intrinsic value of ______ is ______ its par value, so that the bond is __________________.

Gwen your computation and conclusions, which of the following statements is true?

o When the coupon rate is greater than Olivia’s required return, the bond should trade at a premium.

o A bond should trade at a par when the coupon rate is greater than Olivia's required return.

o When the coupon rate is greater than Olivia’s required return, the bond's intrinsic value will be less than its par value.

o When the coupon rate is greater than Olivia's required return, the bond should trade at a discount.

CouponA coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Financial Reporting Financial Statement Analysis and Valuation a strategic perspective

ISBN: 978-1337614689

9th edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw