Use the templates in Tables 4-1, 4-2, and 4-3 to recast the financial statements for Nordstrom, Inc.

Question:

Use the templates in Tables 4-1, 4-2, and 4-3 to recast the financial statements for Nordstrom, Inc.

-1.png)

Cash Flow Statement Standardization

-2.png)

-3.png)

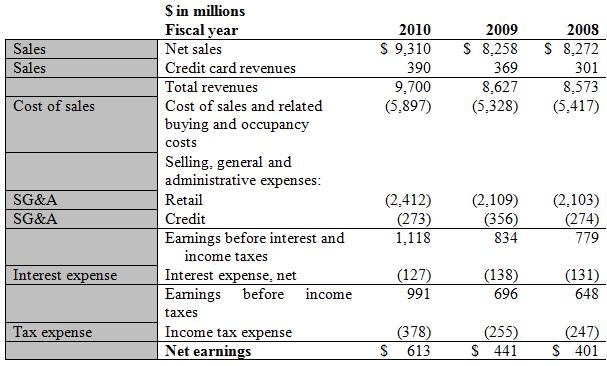

Income Statement Standardization

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Transcribed Image Text:

Balance Sheet Standardization Jan. 29 2011 Jan. 30 2010 S in millions Assets Current assets Cash and marketable securities Accounts receivable Inventorv Other current assets Other current assets Cash and cash equivalents S1,506 S795 2,026 2,035 898 Accounts receivable, net Merchandise inventories 977 Current deferred tax assets, net Prepaid expenses and other Total current assets Land, buildings and equipment (net 2,318 2,242 of accumulated depreciation of S3,520 and S3,316) Goodwill Other assets Total assets Liabilities and Shareholders Equity Current liabilities 4,824 4,054 Long-term tangible assets Long-term intangible assets Other long-term assets 53 230 S7,462 S6,579 53 267 Accounts pavable Other current liabilities Accounts payable S 846 S 726 336 Accrued salaries, wages and related benefits 375 Other current liabilities Short-term debt Other current liabilities 652 596 356 Current portion of long-term debt Total current liabilities Long-term debt, net Deferred property incentives, net Other liabilities Commitments and contingencies Shareholders' equity.: Long-term debt Other long-term liabilities Other long-term liabilities 1.8792,014 2,775 2,257 469 495 292 Common shareholder equity Common stock, no par value 1,000 shares authorized; 218.0 and 217.7 share issued and outstanding 1,168 1,066 Common shareholder equit Retained earnings Accumulated other 882 (29) 525 (19) Common shareholder equity comprehensive loss Total shareholders equitv Total liabilities and shareholders' S 7,462 S 6,579 equity 2,021 1,572 S in millions Fiscal vear Operating Activities Net eamings Adjustments to reconcile net earnings to net cash provided by 2010 2009 2008 Net income S 613 S441 S 401 operating activities Long-term operating accruals depreciation and amortization Long-term operating accruals depreciation and amortization Long-term operating accruals Depreciation and amortization of Amortization of deferred property Deferred income taxes, net Stock-based compensation Tax benefit from stock-based Excess tax benefit from stock 327 302 (21) 2 (58) (36) 28 313 buildings and equipment (54) (42) ncentives and other, net Long-term operating accruals - other 42 32 expense Long-term operating accruals other compensation Long-term operating accruals other (16) (7) (4) based compensation Net (investment in) or liquidation Provision for bad debt expense of operating working capital 149 25 173 Change in operating assets and liabilities Net (investment in) or liquidation of operating working capital Net (investment in) or liquidation Merchandise inventories of operating working capital Net (investment in) or liquidation of operating working capital Net (investment in) or liquidation of operating working capital Net (investment in) or liquidation of operating working capital Net (investment in) or liquidation of operating working capital Net (investment in) or liquidation of operating working capital Net (investment in) or liquidation of operating working capital Accounts receivable (74) (159) (93) (80) (1) 53 1 (38) 38 Prepaid expenses and other Accounts payable Accrued salaries, wages and Other current liabilities assets 72 168 37 120 (54) 4281 (48) 95 96 119 6 48(29) 1,177 1,251 848 related benefits Deferred property incentives Other liabilities Net cash provided by operating actiities Investing activities (399) (360) (563) Net (investment in) or liquidation Capital expenditures of operating long-term assets Net (investment in) or liquidationChange in credit card receivables (66) (182) (232) of operating long-term assets originated at third parties Net (investment in) or liquidation Other, net Net cash used in investing activities Financing activities commercial paper borrowings of operating long-term assets (462) (541) (792) Net debt (repayment) or issuance Net debt (repayment) or issuance Net debt (repayment) or issuance ncipal payments on long-term (356) (25) (410) epayments) proceeds from (275) 275 Proceeds from long-term borrowings, net of discounts 498 399 150 borrowingS Net debt (repayment) or issuance Dividend (payment) Net stock (repurchase) or issuance Net stock (repurchase) or issuance Proceeds from exercise of stock 35 21 13 Increase in cash book overdrafts 37 9 20 (167) (139) (138) (264) Cash dividends paid Repurchase of common stock (84) options Net stock (repurchase) or issuance Proceeds from employee stock 13 13 17 Net stock (repurchase) or issuance Excess tax benefit from stock Net stock (repurchase) or issuance Other, net purchase plan 16 74 based compensation 4 3(9) (4) 13 (342) Net cash (used in) provided by tinancing activities Net increase (decrease) in cash and cash equivalents 711 723 (286)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 55% (18 reviews)

The resulting standardized financial statements are as follows Nordstrom Standardized Balance Sheet in millions January 29 2011 January 30 2010 ASSETS ...View the full answer

Answered By

Bree Normandin

Success in writing necessitates a commitment to grammatical excellence, a profound knack to pursue information, and a staunch adherence to deadlines, and the requirements of the individual publication. My background comprises writing research projects, research meta-analyses, literature reviews, white paper reports, multimedia projects, reports for peer-reviewed journals, among others. I work efficiently, with ease and deliver high-quality outputs within the stipulated deadline. I am proficient in APA, MLA, and Harvard referencing styles. I have good taste in writing and reading. I understand that this is a long standing and coupled with excellent research skills, analysis, well-articulated expressions, teamwork, availability all summed up by patience and passion. I put primacy on client satisfaction to gain loyalty, and trust for future projects. As a detail-oriented researcher with extensive experience surpassing eight years crafting high-quality custom written essays and numerous academic publications, I am confident that I could considerably exceed your expectations for the role of a freelance academic writer.

5.00+

7+ Reviews

21+ Question Solved

Related Book For

Business Analysis Valuation Using Financial Statements

ISBN: 978-1111972301

5th edition

Authors: Paul M. Healy

Question Posted:

Students also viewed these Accounting questions

-

a) You are provided with the following information relating to V ltd Equity and liabilities 12% debentures (shs1000 at par) 16,000 10% preferences shares 6,250 Ordinary shares (Sh. 10 par) 12,500...

-

Use tables such as Tables 2 and 3 to illustrate what happens to bank balance sheets when each of the following transactions occurs: a. You withdraw $100 from your checking account to buy concert...

-

Use Tables C. 1 to C. 4 to complete the following schedule: Table Values n4 n:7 n 10 FV of $1 PV of $1 FV of annuity of $1 PV of annuity of$1

-

You have $300,000 saved for retirement. Your account earns 6% interest. How much will you be able to pull out each month, if you want to be able to take withdrawals for 20 years? $ Get help: Video

-

A pump has a 2 kW motor. How much liquid water at 15oC can I pump to 250 kPa from 100 kPa?

-

Classify each as nominal-level, ordinal-level, intervallevel, or ratio-level measurement. a. Pages in the 25 best-selling mystery novels. b. Rankings of golfers in a tournament. c. Temperatures...

-

We first study 3-PBA, a commonly used insecticide found in grains, fruits, and vegetables. How much higher are 3-PBA concentrations while not eating organic versus eating organic? A bootstrap...

-

Job-order costing in a manufacturing company Ferguson Corporation builds sailboats. On January 1, 2012, the company had the following account balances: $65,000 for both cash and common stock. Boat 25...

-

s Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Required: 1. Compute the plantwide predetermined...

-

You are the accountant at Indigo. Refer to Appendix III for Indigos Consolidated Balance Sheet as at March 31, 2018. Your manager has assigned you the following tasks. a. Calculate the current ratio,...

-

Fair value accounting attempts to make financial information more relevant to financial statement users, at the risk of greater subjectivity. What factors would you examine to evaluate the...

-

Refer to the Creative Technology example on delaying write-downs of current assets. How much excess inventory do you estimate Creative Technology is holding in March 2005 if the firms optimal days...

-

Imagine that you are a statistical consultant and a researcher comes to you with a problem. The researcher has a random sample of data from each of six groups, and she wants to test whether the means...

-

Carnoustie Capital Management, Ltd. (CCM), a UK-based global investment advisory firm, is considering adding an emerging market currency product to its offerings. CCM has for the past three years...

-

Based on her investigation, Al-Khalili would most likely recommend: A. active currency management. B. a hedging ratio closer to 100%. C. a narrow discretionary band for currency exposures. Kalila...

-

Which of Yellows statements regarding the factors affecting the selection of a trading strategy is correct? A. Statement 1 B. Statement 2 C. Statement 3 Robert Harding is a portfolio manager at...

-

Discuss two advantages of Hedge Fund B relative to Hedge Fund C with respect to investment characteristics. Sushil Wallace is the chief investment officer of a large pension fund. Wallace wants to...

-

Given the parameters for the benchmark given by Harding, Yellow should recommend a benchmark that is based on the: A. arrival price. B. time-weighted average price. C. volume-weighted average price....

-

Refer to the preceding information for Fast Cools acquisition of Fast Airs common stock. Assume Fast Cool issues 35,000 shares of its $20 fair value common stock for 80% of Fast Airs common stock....

-

The May 2014 revenue and cost information for Houston Outfitters, Inc. follow: Sales Revenue (at standard).............. $ 540,000 Cost of Goods Sold (at standard) ..........341,000 Direct Materials...

-

Steam at \(120^{\circ} \mathrm{C}\) and \(101.3 \mathrm{kPa}\) is added to a hollow steel can that is then sealed and allowed to cool. (a) What is the pressure inside the can at \(101^{\circ}...

-

Using the data in BE4-6, journalize and post the entry on July 1 and the adjusting entry on December 31 for Craig Insurance Co. Craig uses the accounts Unearned Service Revenue and Service Revenue.

-

The bookkeeper for Forseth Company asks you to prepare the following accrual adjusting entries at December 31. (a) Interest on notes payable of $300 is accrued. (b) Service revenue earned but...

-

The bookkeeper for Forseth Company asks you to prepare the following accrual adjusting entries at December 31. (a) Interest on notes payable of $300 is accrued. (b) Service revenue earned but...

-

Over a period of four and half years an investment grows to $ 2 0 , 0 0 0 . ( a ) If money in this investment accummlated at a simple interest rate of 8 % , what was the initial amount for the...

-

It is December 3 1 , 2 0 2 3 . Lincoln has an asset ( Basis $ 1 0 , 0 0 0 ; FMV = $ 4 0 , 0 0 0 ) . The gainon the asset is subject to depreciation recapture and will result in $ 3 0 , 0 0 0 in...

-

Define and explain the four basic functions that constitute the management process? What is a partnership? List four advantages and disadvantages of operating a business as partnership? Give an...

Study smarter with the SolutionInn App