Using the corporate tax rate schedule given in Table 2.1, perform the following: a. Calculate the tax

Question:

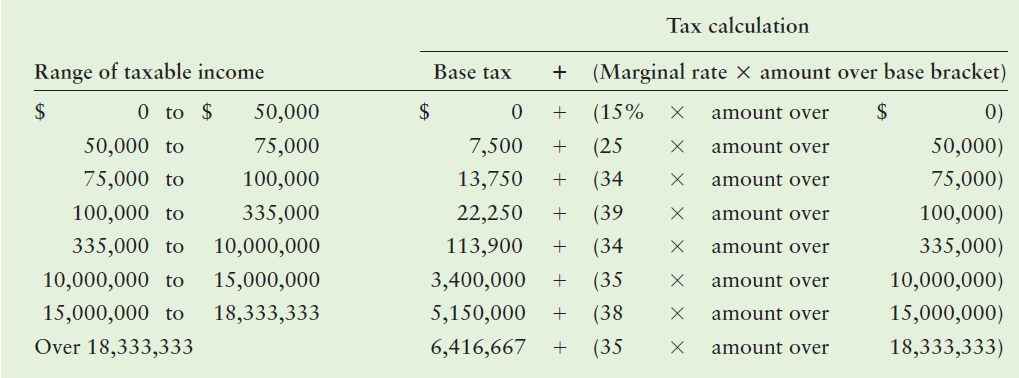

Using the corporate tax rate schedule given in Table 2.1, perform the following:

a. Calculate the tax liability, after-tax earnings, and average tax rates for the following levels of corporate earnings before taxes: $10,000; $80,000; $300,000; $500,000; $1.5 million; $10 million; and $20 million.

b. Plot the average tax rates (measured on the y axis) against the pretax income levels (measured on the x axis). What generalization can be made concerning the relationship between these variables?

Table 2.1

Transcribed Image Text:

Tax calculation Range of taxable income 50,000 (Marginal rate X amount over base bracket) Base tax 0) 0 to $ amount over $ 2$ (15% (25 50,000) 75,000) 100,000) 335,000) 10,000,000) 15,000,000) amount over 50,000 to 75,000 7,500 (34 (39 (34 (35 (38 (35 amount over 75,000 to 100,000 13,750 amount over 335,000 100,000 to 22,250 amount over 335,000 to 10,000,000 113,900 10,000,000 to amount over 3,400,000 15,000,000 amount over 5,150,000 15,000,000 to 18,333,333 Over 18,333,333 amount over 6,416,667 18,333,333) + + + +

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 58% (24 reviews)

a Tax calculations using Table 21 10000 Tax liability 10000 015 1500 Aftertax earnings 10000 1500 85...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Principles Of Managerial Finance

ISBN: 978-0136119463

13th Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Question Posted:

Students also viewed these Finance questions

-

22 For the argon-40 shown in the figure, find (a) the atomic number. (b) the number of neutrons. 1 point for part (a) 1 point for part (b) * Enter your answer (2 Points) 23 An aircraft increased its...

-

Using the corporate tax rate schedule given in Table, perform the following: a. Calculate the tax liability, after-tax earnings, and average tax rates for the following levels of corporate earnings...

-

Given the U.S. Corporate Tax Rate Schedule in Exhibit 10.6, what is the marginal tax rate and average tax rate of a corporation that generates a taxable income of $12 million in 2012?

-

Jerome Neeson is a shareholder in Gourmet Chefs Inc., a company that owns and operates a test kitchen in a large metropolitan area. The company is involved in a number of businesses, including...

-

Gina Milan is the new manager of Plenty Parking Ltd., a parking garage. She has heard about internal control but is not clear about its importance for the company. Explain to Gina the six control...

-

Which of the following mutations affecting proteins involved in the intracellular signaling pathway that is activated by epidermal growth factor (EGF) would you expect to promote cancer? A. A...

-

Consider the study from Example 3.4. Recall that the clinical trial consists of 450 patients. 150 of the patients have stage I cancer and the rest have stages II-IV cancer. In Computation Lab:...

-

James Banks was standing in line next to Robin Cole at Klecko's Copy Center, waiting to use one of the copy machines. "Gee, Robin, I hate this," he said. "We have to drive all the way over here from...

-

On October 1, 20Y8, Jacinto Suarez and Tricia Fritz form a partnership. Suarez agrees to invest $25,000 in cash and inventory valued at $60,000. Fritz invests certain business assets at valuations...

-

After completing this week's readings and viewing Chimamanda Ngozi Adichie and Roxane Gay's TED Talks, answer the following: Do you consider yourself to be a feminist? Why or why not? Be sure to...

-

Tantor Supply, Inc., is a small corporation acting as the exclusive distributor of a major line of sporting goods. During 2010 the firm earned $92,500 before taxes. a. Calculate the firm?s tax...

-

Using the corporate tax rate schedule given in Table 2.1, perform the following: a. Find the marginal tax rate for the following levels of corporate earnings before taxes: $15,000; $60,000; $90,000;...

-

Given that f (x) = x2 + 4 and g(x) = 3x + 5, find each of the following. a. The domain of f - g b. The domain of f / g c. (f - g) (x) d. (f/g) (2)

-

Calculate the mean, variance, and skewness coefficient for the data given in Table 4.9. Is the distribution symmetric ? Table 4.9 Year 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 Sum...

-

The United States brought a lawsuit requesting forfeiture of a \($38.5\) million jet purchased by Teodoro Nguema Obiang Mangue (Nguema) because the government believed the jet had been purchased with...

-

In 1990 Congress passed the Gun-Free School Zone Act that made it unlawful to possess a firearm in a school zone. A highschool senior carried a concealed and loaded handgun into his high school and...

-

What are the primary advantages of resolving a case through alternative dispute resolution methods rather than going to trial? In what situations might a trial be preferable?

-

Update the head coaching situation in the NFL. How has the number of head coaches of color changed since this books printing? Has the NFLs Rooney Rule been changed? Discuss why you believe the...

-

Discuss the advantages and limitations of reporting alternative performance measures.

-

Annual dividends of ATTA Corp grew from $0.96 in 2005 to $1.76 in 2017. What was the annual growth rate?

-

Consider the routes from A to B and notice that there is now a barricade blocking the path. Work out a general solution for the number of paths with a blockade, and then illustrate your general...

-

Hayes Enterprises began 2019 with a retained earnings balance of $928,000. During 2019, the firm earned $377,000 after taxes. From this amount, preferred stockholders were paid $47,000 in dividends....

-

Listed are the equity sections of balance sheets for years 2018 and 2019 as reported by Mountain Air Ski Resorts Inc. The overall value of stockholders equity has risen from $2,000,000 to $7,500,000....

-

Bauman Companys total current assets, total current liabilities, and inventory for each of the past 4 years follow: a. Calculate the firms current and quick ratios for each year. Compare the...

-

As of June 30, Year 1, the bank statement showed an ending balance of $16,878. The unadjusted Cash account balance was $15,239. The following information is available: 1. Deposit in transit, $2,190....

-

Superior Company provided the following data for the year ended December 31 (all raw materials are used in production as direct materials): Selling expenses Purchases of raw materials Direct labor...

-

Marin Company produces two software products (Cloud-X and Cloud-Y) in two separate departments (A and B). These products are highly regarded network maintenance programs. Cloud-X is used for small...

Study smarter with the SolutionInn App