Venus Candy Company budgeted the following costs for anticipated production for September 2010: Prepare a factory overhead

Question:

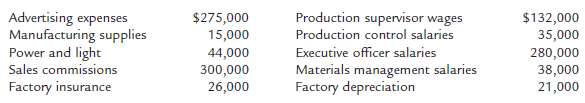

Venus Candy Company budgeted the following costs for anticipated production for September 2010:

Prepare a factory overhead cost budget, separating variable and fixed costs. Assume that factory insurance and depreciation are the only factory fixed costs.

Transcribed Image Text:

Production supervisor wages Production control salaries Executive officer salaries Materials management salaries Factory depreciation Advertising expenses Manufacturing supplies Power and light Sales commissions Factory insurance $275,000 15,000 44,000 $132,000 35,000 280,000 300,000 26,000 38,000 21,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 52% (17 reviews)

VENUS CANDY COMPANY Factory Overhead Cost Budget For the Month Ending September 30 2010 Variabl...View the full answer

Answered By

Anoop V

I have five years of experience in teaching and I have National Eligibility in teaching (UGC-NET) .

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Managerial Accounting questions

-

Nutty Candy Company budgeted the following costs for anticipated production for August: Prepare a factory overhead cost budget, separating variable and fixed costs. Assume that factory insurance and...

-

Venus Candy Company budgeted the following costs for anticipated production forSeptember 2010: Prepare a factory overhead cost budget, separating variable and fixed costs. Assume that factory...

-

Blondie Candy Company budgeted the following costs for anticipated production for July 2012: Prepare a factory overhead cost budget, separating variable and fixed costs. Assume that factory insurance...

-

Apply Theorem 3 to calculate the matrix exponential e At for each of the matrices in Problems 35 through 40. A = 13 3 3 3 01 3 3 00 23 0002

-

The following data (in millions) were taken from recent annual reports of Apple Inc., a manufacturer of personal computers and related products, and Mattel Inc., a manufacturer of toys, including...

-

There is an array A made of N integers. Your task is to choose as many integers from A as possible so that, when they are put in ascending order, all of the differences between all pairs of...

-

Benger Engineerings trial balance contains the following account balances at 30 June. Required (a) Prepare the closing entries under the perpetual inventory system. Debit Credit Inventory Belinda...

-

American International Automotive Industries (AIAI) manufactures engine, transmission, and chassis parts for manufacturers and repair companies in the United States, South America, Canada, Mexico,...

-

15.A ray of light is incident on a slab as shown in figure. The refractive index of medium of slab changes as =1+ y. The angle made by ray with x-axis at y = 2 is 30 0 air 2

-

Trimake Limited makes three main products, using broadly the same production methods and equipment for each. A conventional product costing system is used at present, although an activity-based...

-

Levi Strauss & Co. manufactures slacks and jeans under a variety of brand names, such as Dockers? and 501 Jeans?. Slacks and jeans are assembled by a variety of different sewing operations. Assume...

-

The controller of Swiss Ceramics Inc. wishes to prepare a cost of goods sold budget for June. The controller assembled the following information for constructing the cost of goods sold budget: Use...

-

A restaurant chain is planning to purchase 100 ovens from a manufacturer, provided that these ovens pass a detailed inspection. Because of high inspection costs, 5 ovens are selected at random for...

-

Two new methods of assessment provided by the consulting firm were chosen for experimentation. The first is a paper-and-pencil clerical test assessing clerical speed and accuracy. It contains 50...

-

3. Suppose that g is given by the graph at left in Figure 5.3 and that A is the corresponding integral function defined by A(x) = g(1) dt. 3+ 6 MA -10 3+ Mat 3 5 Figure 5.3: At left, the graph of y=...

-

The owner of a small business is considering investment alternatives for his wealth of $100,000.One alternative is to keep it in a savings account that pays interest at rate15%per year. The second...

-

Two identical strings 7, and 12 are fixed at the boundaries. Although they are vibrating with the sam frequencies, they show different mode shapes due to the tension in the strings. (See the figures...

-

MedPharm Limited is a manufacturer of medicinal vaccines. MedPharm has manufacturing assembly lines in Germany and South Africa. In an effort to help curb the spread of the coronovirus, they have...

-

Colgate-Palmolive Company operates two product segments. Go to the company Web site (http://www.colgatepalmolive.com), and then click on the For Investors link. From there, go to the SEC filings and...

-

Record the following selected transactions for March in a two-column journal, identifying each entry by letter: (a) Received $10,000 from Shirley Knowles, owner. (b) Purchased equipment for $35,000,...

-

Use the values for V C and V o.c. obtained in Problems 4.36 and 4.39 to find the Thvenin equivalent of the circuit of Fig. 4-48 seen by the 2-A current source. Data from Problem 4.36 In the circuit...

-

Birchem Company, which sells electric razors, had $260,000 of cost of goods sold during the month of June. The company projects a 5 percent increase in cost of goods sold during July. The inventory...

-

The budget director for Lenoir Window Cleaning Services prepared the following list of expected operating expenses. All expenses requiring cash payments are paid for in the month incurred except...

-

Executive officers of Shavez Company are wrestling with their budget for the next year. The following are two different sales estimates provided by two different sources. Shavezs past experience...

-

1. In an isolated calorimeter, 105 g of water is placed in a 20-g aluminum cup. Both the water and the cup start at 32 C. 15 g of ice, initially at 0 C is added to the water and the system is allowed...

-

Self-Travel, a car rental firm, has two methods of charging for car rental: Method 1 $64 per day + 25 cents per kilometre Method 2 $89 per day with unlimited travel a Write a rule for each method if...

-

18. Lets pretend that there is no air resistance. Determine the potential and kinetic energy for a 1 kg ball dropped at a height of 200 meters at for 3 seconds. SHOW ALL WORK FOR CREDIT. Time of Ball...

Study smarter with the SolutionInn App