Warren City, with sales of $ 2 billion, produces and sells farm equipment. The manufacturing division produces

Question:

Warren City, with sales of $ 2 billion, produces and sells farm equipment. The manufacturing division produces some parts internally and purchases other parts from external suppliers and assembles farm equipment including tractors, combines, and plows. Within the manufacturing division is parts manufacturing, which fabricates a large variety of parts. Parts manufacturing is further subdivided into 12 departments, including screw products, metal stamping and fabrication, plastic injection molding, and steel castings. Each of these parts departments is headed by a department manager whose performance is evaluated along several dimensions: meeting budgeted costs, meeting delivery schedules, improving quality, achieving affirmative action and employee satisfaction goals, and minimizing inventory adjustments. Inventory adjustments occur twice a year after internal auditors conduct a physical inventory of the parts department’s work in process and compare it with the amount of inventory as reported in the work- in- process (WIP) account. For example, if on June 30 the auditors take a physical in-ventory count and find $ 130,000 of physical WIP inventory in the steel castings department but the WIP account reports an inventory balance of $ 143,000, then a negative inventory adjustment of 9.1 percent ( $ 13,000 $ 143,000) is made. Any inventory adjustment, positive or negative, reflects unfavorably on the parts department manager’s performance and results in a reduction in the manager’s bonus. The parts department manager is expected to maintain a tight control of WIP inventories, including ensuring the integrity of his or her department’s accounting reports of WIP. Large inventory adjustments indicate that the manager does not have good control of WIP. Four years ago Warren City adopted JIT production procedures. The result has been a drastic reduction of WIP inventories.

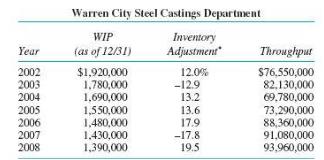

For example, the following data illustrate the steel castings depart-ment’s WIP account balance before adjustments, inventory adjustment, and throughput for the last seven years.

Throughput is the total dollar cost of parts manufactured in the year. It is the sum of the beginning inventory plus direct labor and materials and overhead, less ending inventory. Warren City uses a standard cost system and all inventories are valued at standard cost. When a batch of parts completes production, the WIP inventory is reduced by the standard cost of the part times the standard number of parts in the batch. Each part is manufactured in standard lot sizes.

Inventory adjustments can result for a number of reasons:

1. Different batch sizes. The department manager decides to deviate from standard batch sizes. Unless a special entry is recorded, the accounting system assumes that the number of units in the batch is the standard number. Sometimes the manager has some excess production capacity and decides to increase the standard batch size. In some cases, the manager produces fewer parts than called for by the standard lot size because of machine breakdowns or bottlenecks. For example, suppose a certain part calls for a standard batch size of 150 but the manager decides to produce 200 parts, keeps 50 as spares, but fails to update the WIP account for the additional 50 units. The WIP account contains only 150 at standard cost but the auditors count 200, causing a positive inventory adjustment.

2. Timing differences. The accounting system charges some expenses in a different time period than the department manager expects. This causes the dollar amount of the WIP balance to differ from standard cost.

3. Standard cost revisions. The standard cost of a part is revised and the auditors use a different standard cost in valuing the ending WIP inventory than was used in the WIP account.

4. Audit mistakes. The internal auditors make mistakes in counting the final physical WIP inventory. The first two reasons are by far the most prevalent causes of inventory adjustments.

Required:

a. Management is concerned that the magnitude of the inventory adjustment has increased over time. What are some likely reasons that the absolute value of the inventory adjustment has grown?

b. Evaluate the use of the inventory adjustment described above to measure a parts department manager’s performance.

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Accounting for Decision Making and Control

ISBN: 978-0078025747

8th edition

Authors: Jerold Zimmerman